After a few days of skiing in the backcountry this past week with a good friend of mine, Bob Armstrong (pictured), we came back to civilization in the Village of Whistler. It was stunning how many shops, bars and restaurants were closed due to service sector labour shortages.

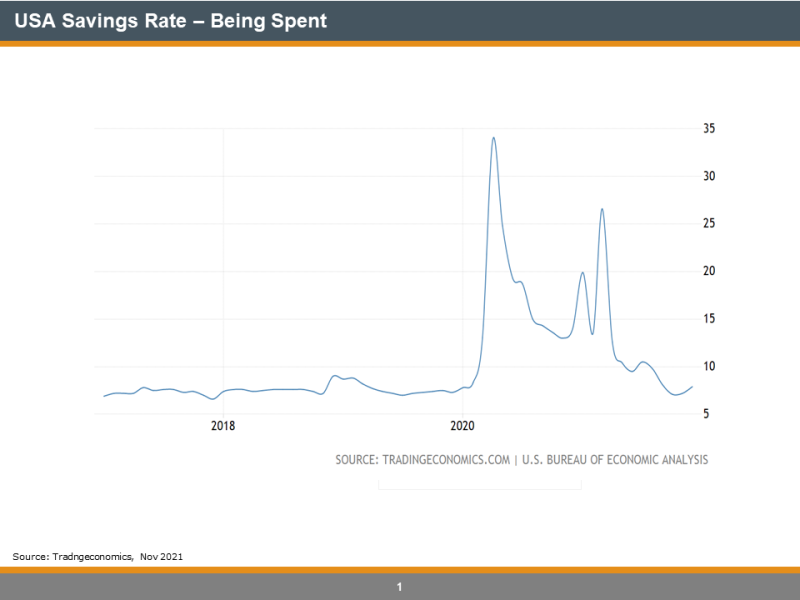

We all know of the massive amount of gov’t subsidies that were paid out to individuals (and businesses) in the form of the CERB in Canada, but that has largely ended in both Canada and the USA. These “stimulus cheques” created a huge Savings Rate as folks were limited in both their ability to travel and spend due to Covid-19 lockdowns beginning in early 2020 and going through various waves/variants. You can see the Savings Rate in the USA skyrocketed (twice) but has recently fallen to pre-pandemic levels.

Two notes on this: 1) When talking heads analyzing the equity markets say there is “tons of cash on the sidelines from stimulus cheques”, I would argue the opposite and 2) Someone may need to go back to work as their savings are largely depleted.

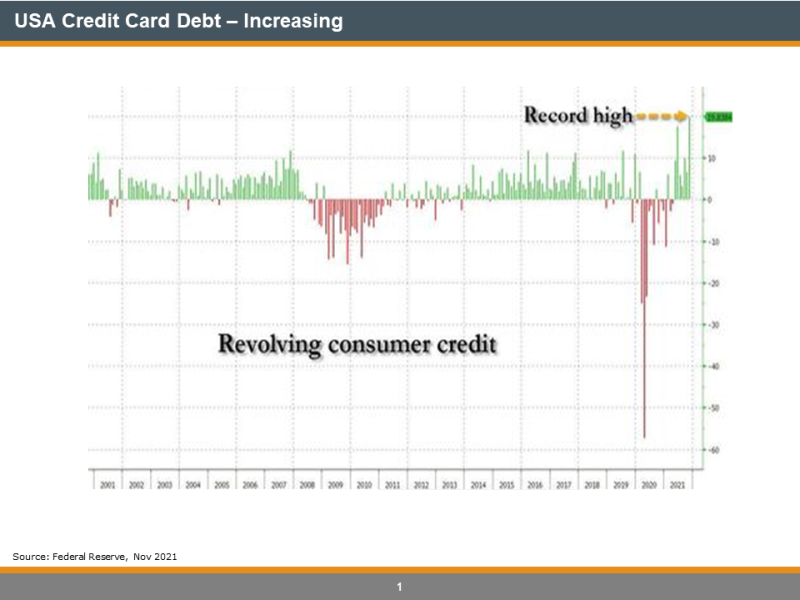

And, making things worse, their credit card balances in the USA look to be going the other way.

From a record low, to a record high in just over one year!

So, what do you do if your savings are depleted and you have now run up credit card debt (obviously the most onerous debt there is)? Get a job, maybe?

I have to think there will be a heavy supply of labour coming back to the service sector as most jurisdictions eliminate lockdowns over this Omicron variant. This supply of labour should ease up on the recent trend in labour price inflation, which, in turn, may ease up on overall consumer price inflation…we can only hope.

And, maybe this decline in USA Savings and increase in USA Credit Card Debt, will slow down on other spending like home renovations, new and used auto purchases, stock market investments, bitcoin investments, etc.

This will all affect the state of the overall economy as, last time I checked, the USA consumer was about 70% of the economy. If it effects the economy, it will affect (certain) businesses and, if it effects businesses, the stock market will be effected. Maybe this is part of what has been going on with the stock market the past 3 weeks?

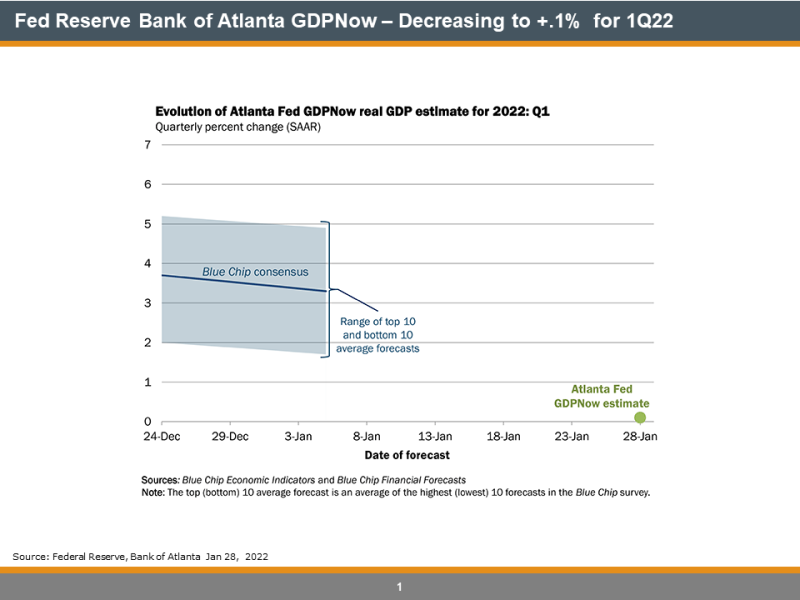

And the Fed (and BoC) are about to begin a rate hike cycle?? Have a look at today’s Fed Reserve Bank of Atlanta’s GDP Now index which models 1Q22 GDP at +0.1%:

Recall the blog I wrote Jan 12th about how recessions begin and end? How Do Recessions Begin and End? It is about to happen in real-time.

If you want to know how we at High Rock think this will play out and what we are buying, holding and not buying to protect our capital, give us a call.