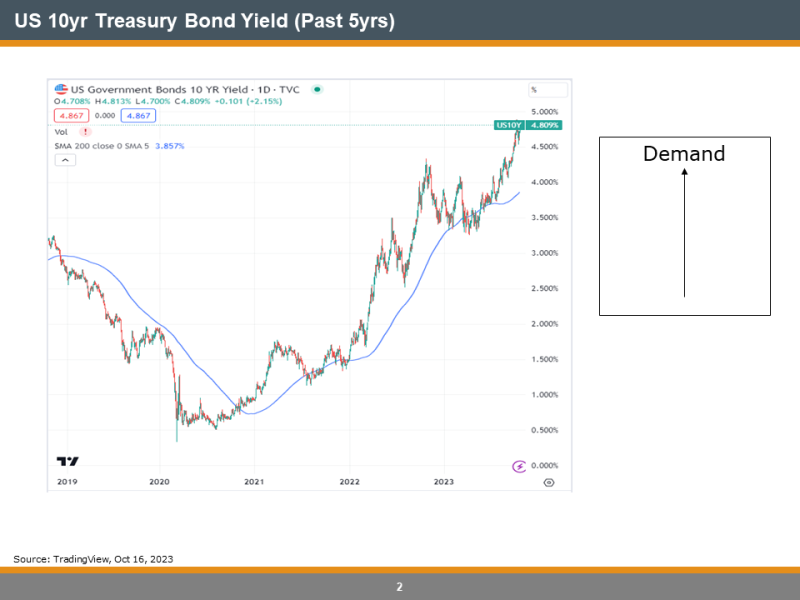

Interest rates (most commonly shown by government bond yields) have been rising dramatically for the past 3 years. Most everyone you talk to asks the question, “when will rates start dropping (and get back to where they were)?”

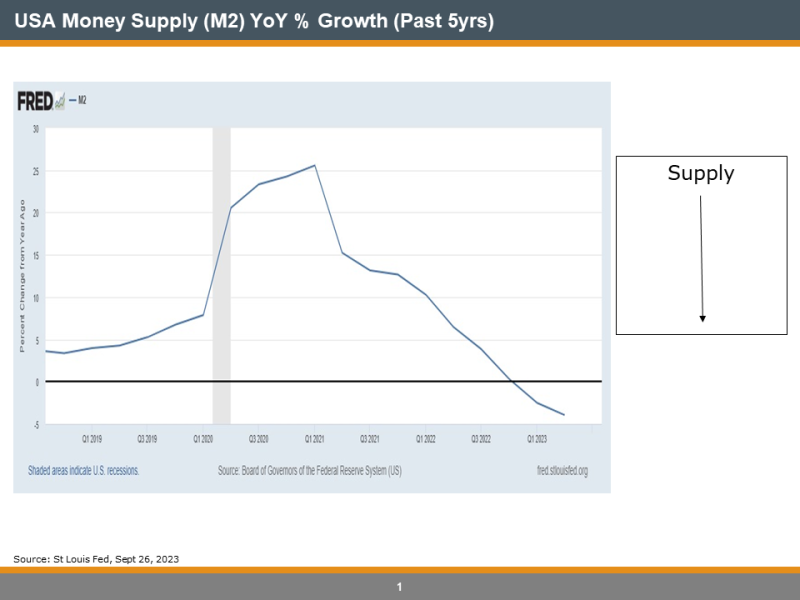

The best answer might lie in Economics 101. If we look at the Supply of Money (as shown by US M2), we can see how it ramped up during the fiscal and monetary response to Covid at a 25% yoy growth rate. Today? Growing about -4% growth rate. IE, the Supply of Money has been declining for coming on 3 years. Figure 1.

And if the Supply of Money goes down, what happens to the Demand for Money? It goes up, which is being reflected in interest rates (10yr US T-bond yields) going up for coming on 3 years. Simple, eh? Figure 2.

So when will rates peak and drop? Likely not until the Supply of Money (M2) at least stops declining and bases out, at a minimum.

And what is High Rock doing to a) take advantage of this situation and b) protecting our capital by hedging out some of the risk that rates may go higher or even stay at these levels? We have been working on a Special Mandate for the past few months. Contact us if you are interested in learning more about what we are doing (and what makes us different).