I did some research on the Housing market in 2017 and then decided to compare the compound annual growth rate (CAGR) of the average/median home price in the GTA vs the Royal Bank of Canada’s (RY) stock price (including reinvesting in dividends) over the same time period. Unfortunately, we lost the blog I wrote in 2017, but here is one I wrote last year Toronto Real Estate vs Royal Bank Stock.

Basically what I am doing is, comparing the CAGR of GTA Homes vs the CAGR of RY stock (those two blogs were over a 20 year period, today I do 10 years). Two notes on this analysis: 1) You have to live somewhere so, if you didn’t own a house and rented, that rent has a cost and 2) Home price appreciation excludes a ton of costs like land transfer tax, property tax, home improvements, basic maintenance, etc. Regardless, you will get the drift.

This is really a Part II to the blog (We Can’t Have our Cake and Eat it too) (as an aside, my middle son, who is studying law, corrected me that it should be “You can’t eat your cake and have it too”…at least he reads my blogs and LinkedIn posts) I wrote on January 18, 2022 where I reason that it is not just houses that have been met with Hyper Asset Price Inflation, it is anything that trades against the C$ (and U$), which is everything – go into a Home Depot to buy lumber…you buy the lumber and you sell them your C$’s. And the reason for this hyper inflation is, Massive Deficit Financing, which ultimately devalues the currency. Do our public policy decision makers understand this macro economic dynamic and it’s unintended consequences or, do they, and know that it buys them votes? I am not sure of the answer but fear it is a bit more of the former than the latter.

Today (and for the past 7 years), all our politicians, public policy officials and even University Professors can talk about is the inflation in the housing market. Really? It is everywhere, not just housing. If you are selling C$’s to buy something else, anything else, then you are met with inflation. I guess my point is, why pick on housing?

Now let’s look at what has inflated more over the past 10 years, the GTA housing market or the Royal Bank of Canada’s stock? Real estate and equities are both asset classes so it is a fair comparison of just two simple examples.

You live in one, but it is also an enormous “cash suck” as it requires taxes be paid and maintenance capital be applied frequently or, it falls into disarray. The expenses and cash sucking goes on and on; just ask any homeowner and they will tell you.

The other, well, you can now buy it for free ($0 commissions) and requires no annual taxes (if you don’t sell) and $0 regular maintenance capital for upkeep; it remains safely tucked away (online) with your custodian. Elegant, really.

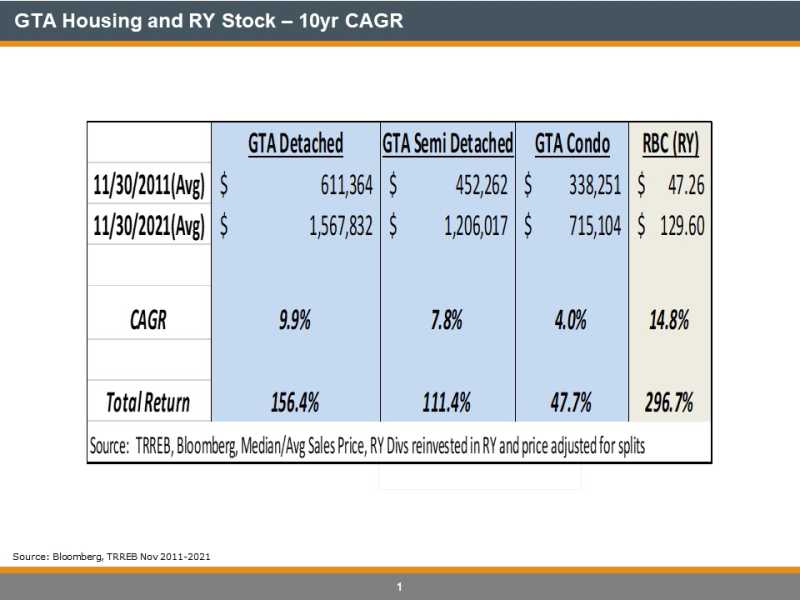

Here is the CAGR for three types of housing in the GTA and the RY stock:

As you can see above in the table, over the past 10 years (ending Nov/21, which, as of writing, is the latest TRREB data), fully-detached housing, arguably the highest priced and most desirable type of housing in the GTA, especially during Covid-19, is up on average +9.9% per year. Again, this excludes all forms of cash outlays and expenses (from taxes to upgrades like new kitchen/bathrooms/rec rooms that add value to the asset). Moving across the right on the table, you can see semi-detached at +7.8% per year and Condos at +4.0% per year.

And what about RY stock over that same time frame? Low and behold, it is +14.8% per year (far right in beige). Remember this is “total return” which means it includes re-investing the dividends every quarter they are paid back into RY stock.

So why pick on housing? When was the last time a politician complained stocks, like RY, was out of reach for investors? Or lumber needed to do basic maintenance was out of reach for home owners? Or used cars so people can get to work or buy groceries (up some 20-44% over the past year alone according to cargurus.ca)? Or gasoline to put in those used cars? Or natural gas used to heat/cool our homes? Or meat at the grocery store to feed our families? Every one of these examples are all up more than housing prices in the GTA. When we see beer, wine and spirits up 40% year over year, well that will be a real problem!

The fix is not to tinker with public policy on housing. The result of such misguided public policy will a) have the inverse effect of the intention, as past policy decisions did or b) create a depression.

Rather, why not fix all forms of Hyper Asset Price Inflation with running balanced budgets? The only answer to that question is…it doesn’t “buy” votes.

So we all have to pay and, unfortunately, those who do not own assets (most notably, housing and an investment portfolio) pay dearly by paying more for everything they consume while not getting a hyper lift on the assets they don’t own. The very people the gov’t is trying to help are seriously hurt by this public policy initiative of running massive deficits.

I wrote more blogs this week than I do in six months, but will take a break next week as I go backcountry skiing for a few days in Whistler with a very good friend of mine. Pictured – 2020 trip leaving Kees and Claire hut.