From the Bank of Canada’s April Monetary Policy Report (click the link to see more detail):

“Considerable uncertainty surrounds the medium-term outlook for GDP and potential output. Many issues remain unclear, including the persistence of changes in consumer preferences, the extent of labour market scarring, the implications of weak investment early in the pandemic and the productivity benefits of faster deployment of new digital technologies. Because these factors tend to affect both demand and supply, estimates of when the output gap will close are particularly uncertain.”

Yet, they have raised their level of optimism enough to begin to discuss reductions in quantitative easing. This in turn has pushed the Canadian $ to levels (highs) not seen since January of 2018 at about $1.00 U.S. = $1.24 C or $0.806 U.S. = $1.00 C (at the time of this writing). This has an adverse impact on exports and creates economic “headwinds”.

As always, in their report, they include a list of downside risks to their outlook (which I tend to view as the offset to their usually overly optimistic narrative). Don’t forget that they want to instill confidence in consumers and businesses first and foremost in order to keep them actively participating in the economy. They do have an agenda and this should always be considered.

1) More severe third wave and more persistent pandemic

2) Weaker exports

“The Bank’s estimates of potential output in Canada and globally have been revised up compared with the estimates presented in the October 2020 Report. While significant, these positive revisions leave the projected level of potential output below the levels Bank staff estimated before the pandemic. By 2023, Canada’s potential output level is expected to be about 1 percent below the pre-pandemic estimate.”

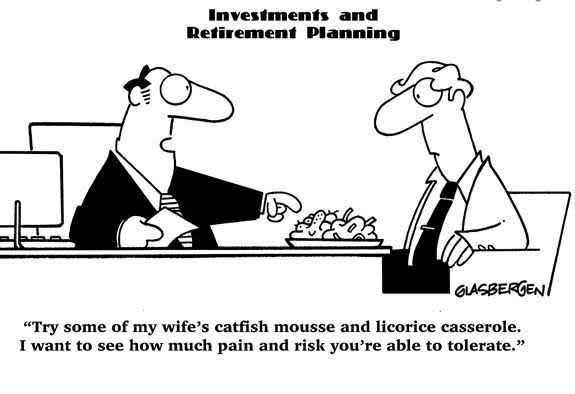

All the largesse (low interest rates and government pandemic benefits) has contributed to a serious bubble in both housing and financial markets. Much of this on the back of central bank and government “tampering” with the natural ebb and flow of the business / economic cycle, preventing what the natural economic forces might have actually created. Clearly this puts these institutions in a very difficult spot: how do they gently back off without causing a financial market meltdown? If they don’t soon begin to step back, however, the bubble could get bigger. It is a very difficult balancing act.

As our friend and brilliant critical thinker (someone not afraid to swim against the current), economist David Rosenberg had to say in his morning note today:

“One last item on the stock market. Defining a bubble means excessive valuations, extreme bullish sentiment and dramatic use of leverage… margin debt has soared 71.6% year over year… This has happened just two other times in the past – December 1999 and June 2007.”

So, clearly there are some very significant undercurrents that the more optimistic agenda’s and narratives (those who believe that this will go on indefinitely) may not be considering in their discussions. Timing is, of course, never easy and rarely exact, but we should be prepared for a more realistic return to the economic cycle when the “tampering” with it is reduced and how that might play itself out. That is a real risk to be mindful of. Manage your expectations accordingly.