As many have heard us say, bond (including credit) markets lead stock markets. Why? Quite simply, bond markets are many times larger than stock markets and the former markets are traded by large Institutions (who are, theoretically, supposed to be “smarter” than Retail investors) while stock markets are largely traded by Retail investors. This could all be argued but, over time, it is likely true, for whatever reason. At a minimum, it pays to look at bond/credit markets for signals about how easily credit is available because it is credit that is the oil in the machine that keeps the economy growing, which, in turn, keeps the stock market growing.

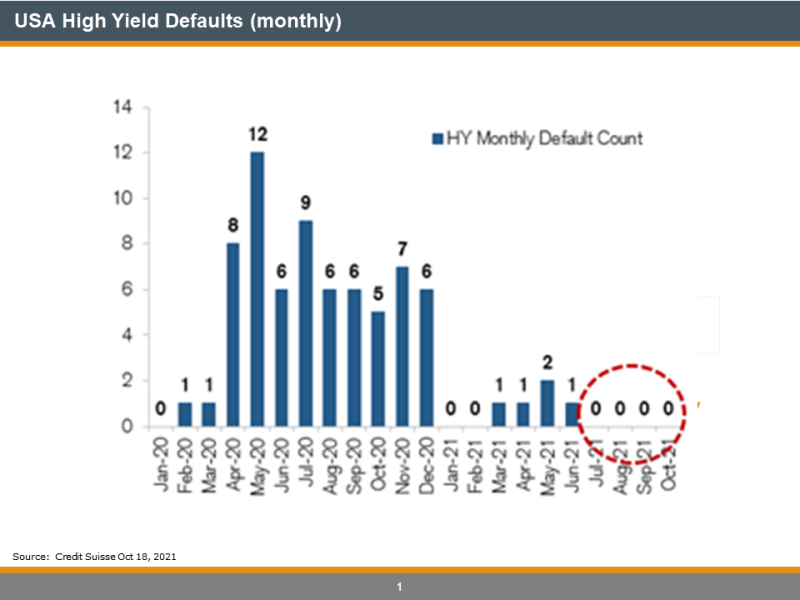

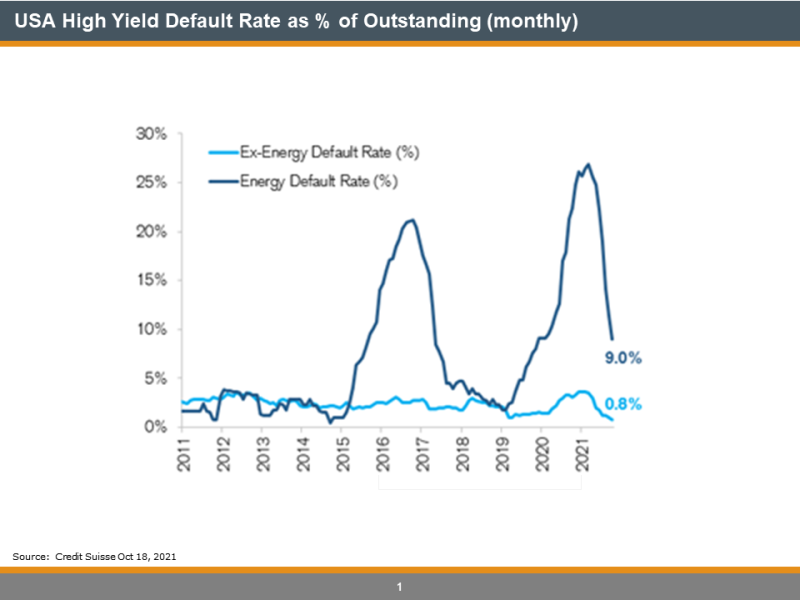

Here is a quick look through some Credit Suisse U$ High Yield charts that shows us the state of the market.

Defaults – there have been “0” defaults for four months in a row! I have been trading and investing in the HY market since 1998 and I do not recall (but I am often wrong) this ever happening before. Lower (or no) defaults is obviously a sign of strength in the credit markets.

Default Rate – as % with and without Energy Bonds – and if we look at the default rate as a % of the outstanding HY bonds we can see that it is negligible when you strip out Energy. With Energy, it is still rather steep at 9%, but down significantly from the cycle peak at 25+% in 2020.

The take-away is the following: 1) Credit markets are strong and in good shape 2) It may mean stock markets could continue to climb this wall of worry 3) With Energy prices where they are, and with free cash flows likely to surprise on the upside, I bet the Default Rate on Energy bonds will continue to drop significantly

Want to know how High Rock is positioned to take advantage of this situation?

Picture – one of my last smallmouth fly fishing mornings for the season (which was spectacular).

Paul Tepsich 416-642-5707