The political and economic winds are definitely swirling and our world is as uncertain a place as I can ever remember in my lifetime.

From our friend David Rosenberg (Early Morning With Dave, February 28, 2022) in his morning missive after the events that have unfolded over the weekend:

“The bottom line is that it likely would be a big mistake to underplay or underestimate the economic and financial consequences of what is happening in Ukraine right now. This is a historic moment, and may well end up being on a scale of Sarajevo in 1914 or Sudetenland in 1938 (see more below on the “worst-case scenario”) — the critical geopolitical observation is that what we are witnessing is a major escalation of Cold War II. And don’t think that Beijing, with its sights set on Taiwan, isn’t paying close attention (indeed, late last week, China flew some soirees over Taiwan, Iran sent drones into Israeli airspace, and North Korea launched a suspected ballistic missile off its east coast yesterday morning). But what’s important is that we shouldn’t be seeing this Ukraine war as just another minor, inconsequential and random geopolitical event, and we don’t really know how far Putin is going to go — except we know that his goal for his entire 22-year tenure has been to rebuild the lost Russian Empire. ”

“After I stated two weeks ago my best-case scenario, which was a diplomatic end to the crisis, I now turn to what the worst-case scenario could be. And it involves a World War III, and I am not being hyperbolic. We are talking about something truly ominous — the current Russian invasion of Ukraine. The knee-jerk response is that Putin is a madman but no, he is a rational megalomaniac who wants to create a new order in Europe, pushing NATO back and recreating the Iron Curtain. All you have to do is read his latest speech and also understand his own history — deep grievances over the “humiliation” of the 1990s when the Soviet Empire crumbled, and he had a front row seat to witness the break-up from Eastern Germany. He isn’t likely to take over Ukraine but rather aim to put in place a puppet government in Kyiv. And he won’t stop there, using history as a guide, unless he is forced to pay an enormous price. We will find out in the coming days and weeks what this price is in military and economic terms.”

And, of course we have just come most of the way (hopefully) through a pandemic which has caused governments and central banks, through their policies (monetary and fiscal), to allow asset prices to bubble and economies to move into a period of stagflation (inflation and slow economic growth).

At the same time differing opinions of the proper way to deal with a pandemic (assisted by the rapid spread of many forms of information through world of social media) and gapping ideological differences have led to heightened levels of civil unrest.

All of these uncertainties are now falling on the shoulders of a large swath of the population (baby boomers) at or on the brink of retirement. It is even more crucial now for these folks to generate investment growth above and beyond higher levels of inflation to maintain a comfortable lifestyle and not run out of money. There is a real and rising risk of longer term returns failing to meet lofty expectations and leaving those who have fallen victim to believing that the last 10 to 12 years of returns will continue (behavioural finance: recency bias) without having to take on enormous amounts of undesirable risk (especially for those who have limited time horizons to recoup losses).

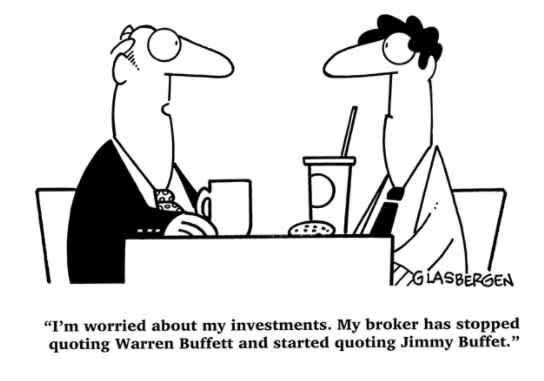

Now, more than ever, is the time to be consulting professionals with the expertise and fiduciary duty to assist you in staying ahead of inflation while at the same time managing the risks associated with volatility in financial markets. Unfortunately, you will not find these with your bank advisor or a mutual fund salesperson or apparent social media experts, no matter how smooth, convincing and optimistic their sales process sounds. These people are paid commissions generated by their sales prowess and that is an enormous conflict of interest that needs to be considered at all times. Especially in times of great uncertainty.

“Let’s start with something simple, like one and one ain’t three

And two plus two will never get you five.

There are fractions in my subtraction and x don’t equal y

But my homework is bound to multiply.”