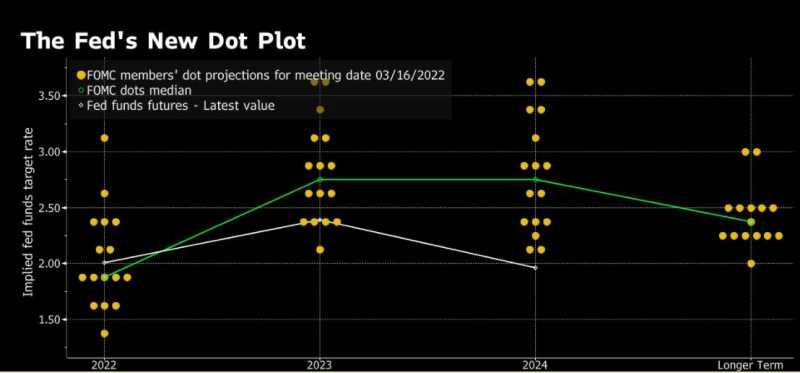

War in Europe, inflation, widening gaps in political ideology, social media driven conspiracies, the future of Covid (Wave 6?) and significantly rising interest rate forecasts (by the U.S. Federal Reserve as indicated in the “Dot Plot”) all point to greater uncertainty (and cloudier crystal balls), but March has been very kind to equity markets (and not so to bond markets): The All Country World Index ETF (ACWI) is higher by 4% since Feb. 28th. Meanwhile the Canadian Bond Index ETF (XBB) is lower by the exact same. The Balanced Portfolio Index ETF (XBAL) is , you guessed it, flat on the month.

The great uncertainty, in my mind, seems to be less so for investors who appear to be jumping back in to stocks. The stock market cheerleaders are firing themselves up again. Stock market investors are breathing easier and growing complacent (as they were through 2021) once again.

As we have stated, ad nauseum, for the last seven years (Yes, High Rock Private Client Wealth Management is turning 7!), bond markets lead all financial markets, so do not lose sight of the reality: rising interest rates burst bubbles.

In his morning missive yesterday, David Rosenberg had this to say:

“this is about respecting probabilities and the historical record. It is to recognize that every recession has followed a Fed tightening cycle. And to acknowledge that the Fed has a track record of 3 soft landings and 11 recessions under its belt.”

Rest assured, the Bank of Canada is in lock-step with The Fed on raising interest rates aggressively.

He added this in his comment this morning:

“What if… the Fed lives up to its call for a 2.8% Fed funds rate?

Well, we traced through the impact on the economy and earnings and the market multiple, and what falls out of the equation is an S&P 500 of 3,750 on this monetary policy path. So best to sell strength until we get to the bottom. We did the same for the S&P Case-Shiller home price index — the effect of this monetary policy on mortgage rates and then a feedback-loop impact to housing affordability and housing demand — and the implications are for a 22% home price collapse.

So as we gaze at the headline consumer and producer inflation data from the supply-side shocks of the pandemic and war, what comes next to dominate the front pages is asset deflation. Asset deflation that ends up curing the inflation staring us in the face today. Shades of what happened from the summer of 2008 to the summer of 2009.”

We have been around financial markets since the early 1980’s, we have seen a great deal more than many of the current stock-happy advisors who always benefit (higher take-home commissions and fees) from rising stock markets, so they have a vested (perhaps conflicted?) interest in seeing stocks go up (the end result of their selling technique?). The more prudent portfolio manager will put their client’s interests first, focusing on protecting their wealth vs. gambling with it. It is paramount to keep this in mind.

If recession probabilities are rising (and they clearly are), reducing debt, reducing exposure to risky assets, finding more tactical growth opportunities and hunkering down, for a while, might be the prudent approach.

I will be travelling to Vancouver May1 through 4 and on to Whitehorse May 4 through 8. I would be thrilled to have any in-person conversations during this time. Let me know!