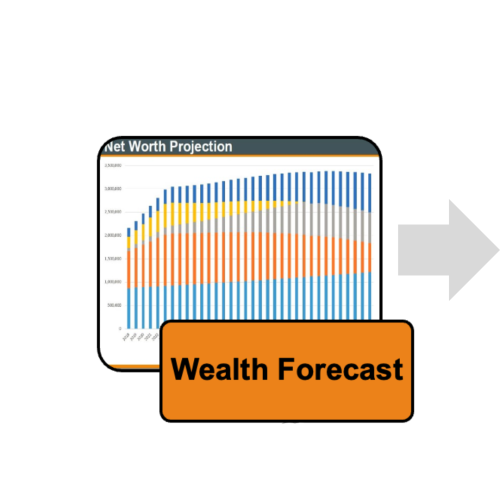

**See image below to Learn More

Proof of enrollment from the Educational Institution of choice ie: a copy of your invoice including your term of enrollment (course breakdown).

Tax slips and Realized Gain/Loss information will be distributed by Raymond James according to the annual CRA Feb 28 th and March 31 st deadlines. If you have chosen to receive your account distributions electronically you will find your tax slips through your online account access.

Yes, HRCMI will set you up for automatic funds transfers to your bank account on a request or recurring basis.

Once you provide High Rock Capital (HRCMI) with your latest investment statement from the delivering institution HRCMI will prepare the required documentation for your signature and initiate the transfer.

copyright©2024 Highrock Capital all rights reserved