Oh no! Not another “reality check” blog!

A good chunk of my day is spent researching the significance of past investor behaviour (behavioural finance / psychology) in an effort to try to get some semblance of what we might expect as we move forward (gazing into a very cloudy crystal ball!). The psychology focuses on the fact that investors are not always rational, have limits to their self-control, and are influenced by their own biases.

In my day to day conversations with prospective clients, what stands out the most is the “recency bias”; the tendency to place too much emphasis on experiences that are freshest in your memory. As they search for better returns (because they keep hearing/reading about “record setting” stock markets) and put their long-term financial plans in jeopardy when they get “sold” on how the (shiny object) double digit returns of the past few years are easy to achieve.

My question to them, always trying to temper expectations, is “what downside are you willing to risk to get those double digit returns?”. The most common answer in response: “but even if they go lower, they will come back up”.

Come back up to where? How long will that take? And do you have the wherewithal to hang on if that doesn’t meet your expectations? Or are you going to make the most common mistake investors make when they go chasing returns? Which is to jump from advisor to advisor who continue to make unachievably optimistic sales pitches, often forgetting to remind them (despite the regulators necessitating it) that … you guessed it: past performance is not a guarantee of future returns.

Central banks have done a good job of helping to create the “recency bias”, giving investors / traders / gamblers and their advisors the sense that they will always be there to backstop the downside to stock markets as they did in late 2018 / early 2019 and in March of 2020. When economic growth does finally return and it likely will, there will be higher inflation expectations feeding back into the financial market psyche. That is already beginning (longer dated maturity bond yields have been rising) because that is what happens, always well in advance of the actuality and of course it always gets overdone, first one way and then another (like the swinging pendulum). While the central banks continue to say they will not be raising interest rates until well into 2022, financial markets are already looking that far ahead. Stock markets have more than built in some 20% plus earnings growth over the next year.

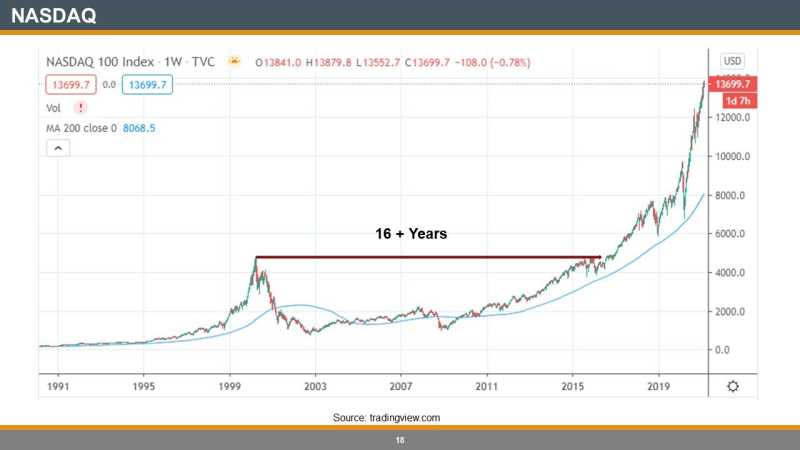

Anybody remember what happened after the dot com bubble burst in 2000? Most millennial’s were pre-teens at that time. The NASDAQ fell some 80% and did not recover back to those highs until 2016. Since then, the NASDAQ has climbed some 200%. Anybody afraid of heights? I am!

Yes, indeed, past performance is not a guarantee of future returns, but at High Rock we work darn hard to get our clients (and ourselves) the best risk-adjusted returns as is possible. This may take us away from the mainstream asset mix to add some non-correlated (to stock market) assets in a portfolio. Interestingly, more and more clients are coming to us (because of our expertise in this area) to get broader asset mixes, given the very lofty valuations in stock markets with way too much money chasing those assets.