The Financial Consumer Agency of Canada has initiated a campaign through the month of November to assist Canadians in becoming more financially literate.

On the good news front, Statistics Canada data reports that from Q4 2019 (pre-Covid) to Q2 2021, Canadian household net worth grew by 21.66% (14.44% annualized). Total assets grew by 19.28% (12.86% annualized): Financial assets grew by 14.79% (9.86% annualized) and Real Estate assets grew by 26.57% (17.71% annualized). Total liabilities grew by 7.63% (5.09% annualized) and Mortgage debt grew by 12.27% (8.81% annualized). In a nutshell, it appears that Canadians have been paying down more expensive debt while growing their assets. Bravo! Less travel more saving?

And…

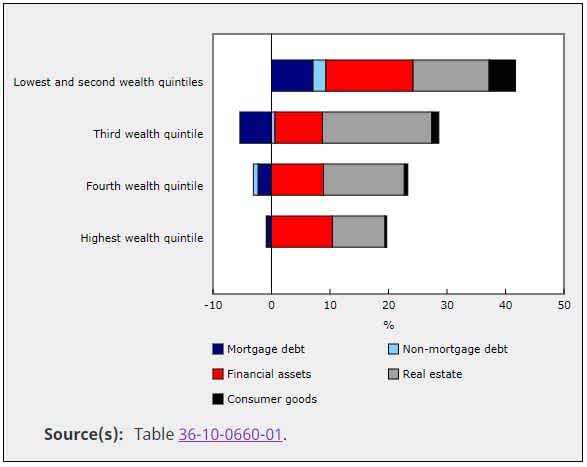

Least wealthy increase share of net worth as their debt declines during the pandemic

“Household wealth reached $14.2 trillion as of the second quarter of 2021, up $2.3 trillion (+19.3%) from the second quarter of 2020. While the wealthiest households (top 20%) held more than two-thirds (67.1%) of all net worth in Canada, those in the two lowest wealth quintiles—which accounted for 40% of all households—held 2.7% as of the second quarter of 2021.

While the value of assets owned by households in the two lowest wealth quintiles was relatively small, averaging $45,500 in financial assets and $88,900 in real estate as of the second quarter of 2021, their average wealth grew faster than other households. The two lowest wealth quintiles increased their net worth by 41.8% in the second quarter of 2021 from the second quarter of 2020, while those in the highest wealth quintile increased their net worth by less than half that rate (+18.8%).

Chart 1 (Statistics Canada): Change in net worth by wealth quintile, including contribution of each wealth component, second quarter of 2021 relative to second quarter of 2020 Households in the two lowest wealth quintiles were the only group that reduced their average debt in the second quarter of 2021 relative to the second quarter of 2020. Decreases in average debt for the two lowest wealth quintiles occurred for both mortgage debt (-5.3%) and non-mortgage debt (-2.2%). Meanwhile, increases in average mortgage debt ranged from 13.3% for the highest wealth quintile to 15.5% for the third wealth quintile.”

The “aha” moment! Saving is important. Too bad it took a pandemic to show us that. We can call it forced saving, as it made us all a little more frugal, but less travel, less dining out, especially for lower income earners can bear fruit as that money went / goes towards building assets. A lesson learned. Next lesson: What risks are out there where your financial assets might experience less than expected (or even, dare I say it, negative) growth?

Stay tuned.