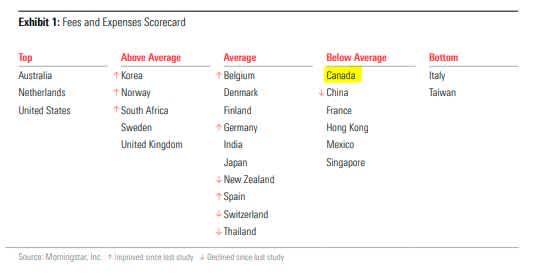

Morningstar, the investor information folks with a mandate to “empower investor success”, recently released their Global Investor Experience Study: Fees and Expenses: ” Morningstar launched the Global Investor Experience study, or GIE, in 2009 to encourage a dialogue about global best practices for mutual funds from the perspective of fund shareholders. We’ve produced the study approximately every two years, with 2022 marking the seventh edition.”

In a nutshell, Canada was ranked as “below average”. Canadians pay, on average, 1.9% for asset allocation funds (optimal diversification), which are the most popular. About 1% of that goes to the advisor as a trailer fee / commission, the balance to the mutual fund company for management, etc.

For now lets leave the conflict of interest argument to your imagination (the mutual fund company, not the client, pays the advisor). None of that fee or commission is tax deductible either. You also have no connection to the portfolio manager, you get what they give you and you only get the regulators protection if the investment was suitable when you bought it (through the advisor’s recommendation). If it does go south (sometime in the future, post purchase), there is no fiduciary protection for you.

Is this the best you can get for your 1.9%? Not only that, if you are targeting a 6-7% annualized return (before fees), your after fee return dwindles to 4.1-5.1%. Over time that can eat up a significant amount of compounding power.

The financial institutions: banks, investment and insurance companies seem to have some kind of lock on Canadian investors with their expensive advertising campaigns that depict a happy retirement for their clients, lulling them into a false sense of confidence. They are seriously conflicted however trying to keep profitability (revenues from their funds) growing in a world where costs to investors (through scale and technology) should actually be shrinking.

What Canadian investors, who pay these outrageous fees, don’t understand is that there are alternatives that they just have not been exposed to that have all the same safety features as the big banks and investment companies built in and more. The smaller, portfolio management companies, who offer discretionary portfolio management, are also legally bound by fiduciary duty (which rules out any conflict of interest and puts the client first). If they are like High Rock, fees are straight forward and transparent and almost half of what these mutual fund fees are. The fees are also tax deductible (in taxable or non-registered accounts). At High Rock you also get to talk directly to the portfolio managers, there are no middle people acting as buffers.

Unfortunately the smaller companies don’t have the big marketing budgets as we try to keep costs to a minimum and pass that on as lower fees to our clients. So we go about our business relying on referrals and introductions from those who we provide our services.

Canadians deserve better, according to Morningstar, and we need to spread the word about the alternatives.