I have written a couple of times the past two months on why we at High Rock felt that US inflation had peaked. You can re-read them here and here.

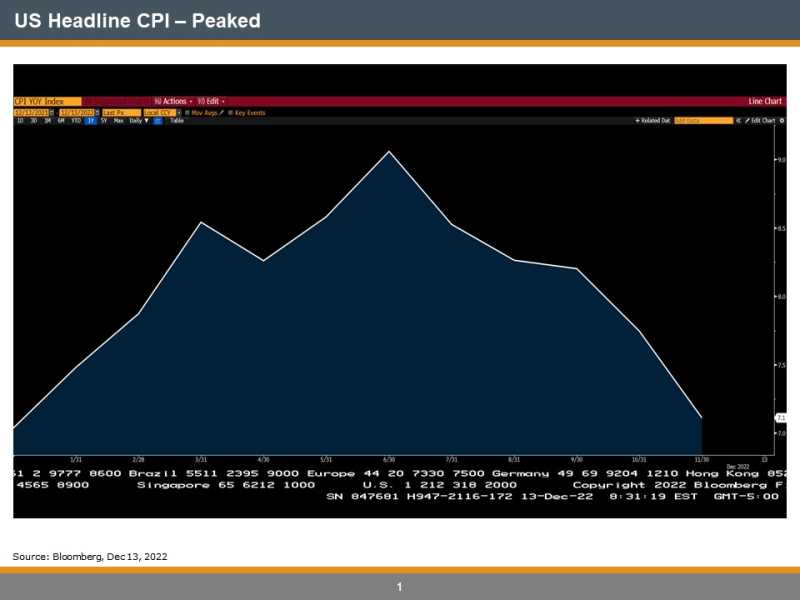

Today, the US released CPI for November. It came out at 7.1% which compared favourably to the 7.3% expected and the 7.7% in October. The peak appears to have been 9.1% in June. You can see US CPI over the past year below:

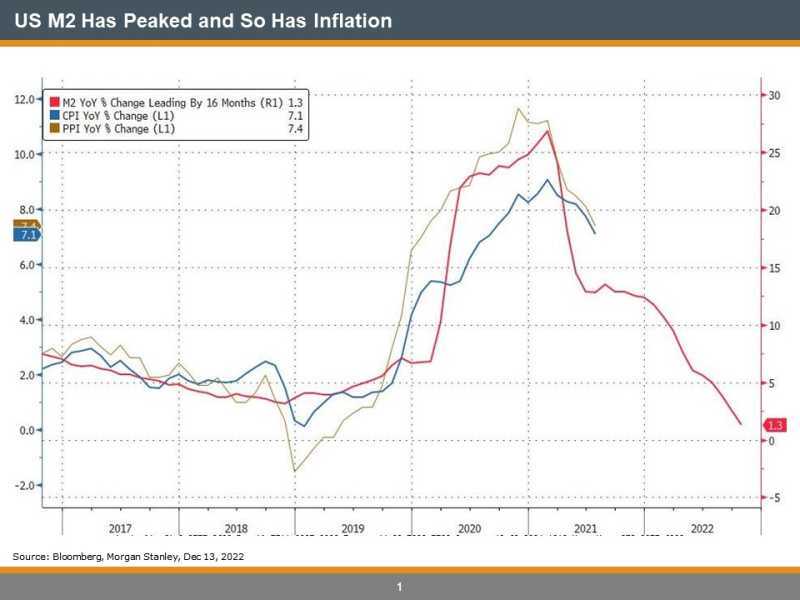

And how do we know inflation has peaked (without a PhD in Economics)? Because inflation is a monetary phenomenon and with Money Supply (M2) dropping dramatically (growing slower than it was pre-Covid), inflation is likely to follow. Here is the updated chart comparing M2 (red line) to CPI (blue line) and PPI (yellow line):

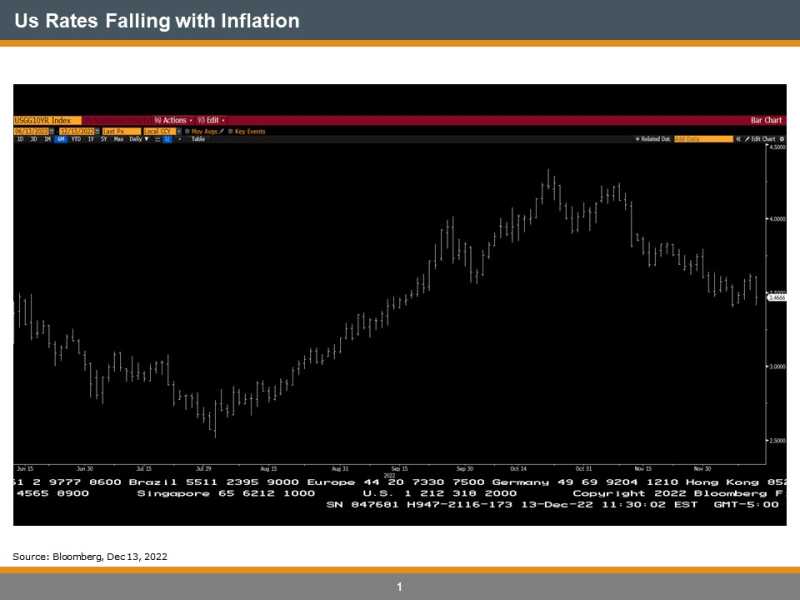

And with inflation having peaked and now falling, US interest rates (government bond yields) are falling with the expectation that either the Fed pauses, or it creates a nasty recession and is forced to cut rates as quickly as they raised them. 10 year US Treasury bond yields as seen below are almost 1% lower from the peak in mid-October. This will affect fixed lending rates in a favourable way.

And what have we at High Rock being doing to express our view from October that inflation (and rates) has peaked? We have been adding to our interest rate exposure through investment grade corporate bonds, fixed rate perpetual preferred shares, some higher rated high yield corporate bonds and the occasional stock. At this stage, we feel the best risk-adjusted returns will come from interest rate risk over equity risk…if the Fed remains stubborn, they will create a nasty recession which will negatively affect stocks, but bonds will likely rally even further as a flight to safety materializes along with the prospect of aggressive easing to combat the recession (if it happens).

Happy Holidays