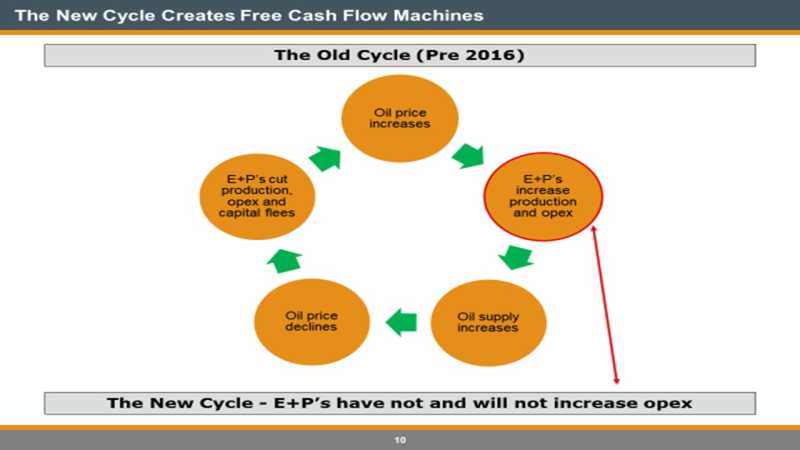

At High Rock, we became more bullish in our Tactical Model on fossil fuel risk in the summer of 2020 as we could see that capital had fled the sector for the past several years (some funds being mandated to not invest in fossil fuel risk and also because of the political environment, particularly in Canada). Regardless the reason, the lack of capital investment in the Energy space in Canada (and the USA), has led these companies to focus on paying down debt at the expense of growing production, which was their previous focus. As you can see in the infographic below, the cycle changed. The New Cycle has seriously underinvested and these producers, who have stared over the cliff a few times the last decade, have now found religion. This religion has created shortages of fossil fuels and just about every other commodity:

Fast forward to today and, with inflation soaring in all assets/commodities, this investment theme is even more important. And it is not just a fossil fuel energy theme. We would rather own the producers of “molecules” who are price setters, rather than the service sector companies who are price takers of molecules (and 10-15% wage inflation). Service sector companies appear to be having a harder time passing through their inflationary costs, while molecule producers are reaping the rewards.

The world is short molecules for fossil fuel energy and various metals for the electrification of the future renewable world. We can’t move to an electrified economy when we are so short all sorts of molecules. Take your pick:

If you want to know our picks, call.