I have been looking after this particular family since I began my second career (first career was as a trader / risk manager of fixed income securities as a VP at a few financial institutions in both Toronto and NYC) in the world of family wealth management in and around the turn of this century. As you can see in the above graph, they are well on their way to achieving their goals. They also have a $500,000 whole life policy that currently has a death benefit of close to $800,000 that will continue to grow and go to their beneficiaries tax free. They can also borrow against it, if they so choose, to be repaid upon death and this is also going to be able to provide tax-free cash flow, if they so desire it. Great diversification, tax efficient and it provides plenty of options and safeguards. But we have also been able to achieve some solid, risk-adjusted returns by which to grow their savings:

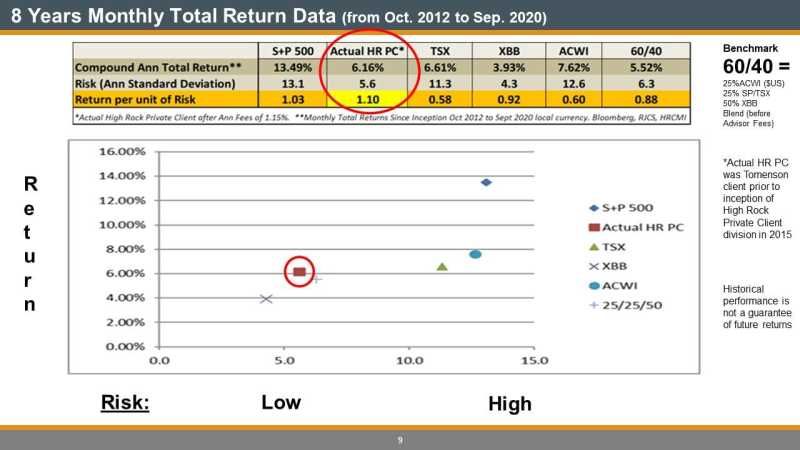

Most of you have seen this table and graph before (and our clients will see it regularly updated in their quarterly reports). What we are focused on (upper table) is the absolute return: Compound Annual Total Return (after fees) and the Return per Unit of Risk taken, relative to the other benchmarks.

We have eight years of history with this client because previous institutions who provided the platform for my wealth management practice considered my clients as theirs and would not release the their data to me under the guise of a privacy policy. Another story for another day, perhaps, but be well advised that this is the proprietary nature of large financial institutions. However, eight years (with two of them having mild negative returns: 2015, 2018) should be ample to show how this strategy of mitigating risk (return per unit of risk taken) has allowed a 60% equity / 40% fixed income portfolio to more than out-perform our relatively conservative 4.5%, after fees, target growth projections.

It works!

Patience is often required. Some, over the years, have lost patience and opted to find a different strategy, usually on a “do it yourself” (DIY) type basis. Others have seen the light and joined the many (now High Rock) clients who believe in making a plan and sticking to it, with a view to the long-term. We can’t control the markets, but we can control our level of exposure to them and the structure of our portfolios to contain and utilize volatility as it occurs. This my friends is called stewardship. Taking the long-term view to building and having wealth that takes you to your end financial (and life) goals and avoiding the noise (and their is so much noise right now) and the “shiny objects” (things that might make you want to gamble your financial livelihood) that other, rather overly optimistic folks, want to sell you.

We are long-term optimistic folks here at High Rock, but cautiously so. Our experience at managing risk has few equals and we know that one way to keep our clients sticking to their plans is to not let them be frightened out of them. Balance, diversity and opportunity, if you wait patiently for it, are the keys to mitigating portfolio risk. The proof is in the above charts and tables.

That being said, and many optimists won’t let you in on this: past performance is not a guarantee of future returns. However, as many of you already know, at High Rock we work darn hard to get our clients (and ourselves) the best possible risk-adjusted returns.

Happy Thanksgiving!

Stay safe, stay healthy!