Historically, every single US recession starts with the US Federal Reserve Board (the Fed) raising their short term borrowing rates, which raise gov’t bond yields (although they rise well in advance of the Fed actually raising rates), which then have a knock-on effect for all kinds of corporate loans, consumer loans, etc. Boom – recession. Guess how recessions end? That’s right – the Fed.

The Fed always raises too much, too quickly and too often and that is what sparks a recession. As a Merrill Lynch colleague once told me in the early 90’s, “the Fed is the oil in the machine”. So when they are accommodative (IE cutting or holding rates low) the economy clips along and most asset prices follow suit having a nice “tailwind”. With the Fed raising rates, well, we have the opposite, a “headwind”. Today, the Fed appears to want to remove the tailwind of low rates and what is now called Quantitative Easing (QE – which is really Fiscal Policy for the Federal Gov’t) and replace it with a headwind of higher rates and Quantitative Tightening.

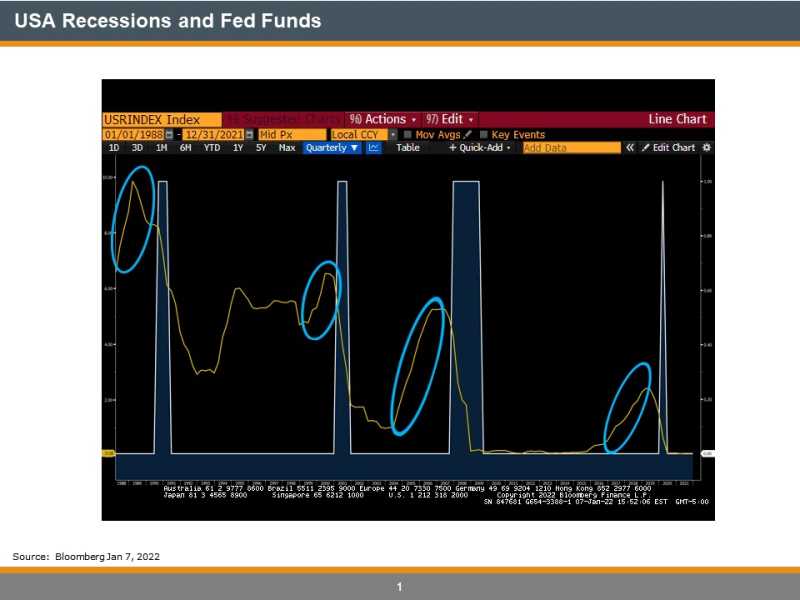

Here is a picture of what has happened the last four recessions. And don’t think it wouldn’t have happened if Covid-19 didn’t happen.

Explanation:

White bars are quarterly recessions

Yellow line is the overnight Federal Funds Rate

Blue ovals signal Fed Funds being hiked up by the Fed…recession follows

See? The Fed is to blame.

Also, note how narrow the Covid-19 recession was. My view is that there is now a combination of so much debt in the world and so much net worth in asset prices (due to government deficit financing creating hyper asset price inflation) that the Fed will react extremely quickly in easing/lowering the Fed Funds rate to limit the downside of the coming recession and to protect that new found Wealth. It may be violent but brief, as the Covid-19 recession was. Quite simply, the Wealth Effect (especially in stocks) is too big to fail. Regardless, the Fed is also the key to ending a recession.

The old style business cycles are gone and have now been replaced with quick reacting central banks who cannot afford a depression due to the massive amount of net worth in asset prices and the massive amount of debt in the system. Micro management.