Anybody find the challenges of 2021 overwhelming? I would be less than truthful if I commented otherwise. Financial markets, however tell a bit of a different tale (and of course hindsight is 20/20):

Risk assets (global equity markets) had a strong showing, while safe assets (bonds and gold) were weaker. Given the uncertainty that we began the year with, it seems to have run counter to what we might have expected. We can thank governments and central banks for juicing both fiscal and monetary stimulus (foot to the floor on the economic gas pedal) for providing the impetus for most of this. The end result, however has produced asset inflation, price inflation and some hint of wage inflation (beginning to show up) that will create some wicked hangover for financial markets to deal with in 2022 and perhaps beyond.

Central banks will likely be raising interest rates (pushing the economic brake pedal) and borrowing costs will take a bite out of the consumer as debt servicing costs escalate. Meanwhile inflation (some argue that it is just a transitory phenomenon, while others see it affecting the psyche of the consumer / household, making it more troublesome) will be an ongoing issue, until it is not.

As money managers, we live our lives in the world of probability and outcome. We must assess the economic and financial landscape and attach probabilities to how situations that affect financial markets may evolve. We have to be students of history to see how investors have reacted in the past and we have to try to put it into some definable context to help us get some vision through the ever increasingly foggy road in front of us. Then we have to take a practical approach to what impact these probable outcomes might have on the goals of the families that have entrusted us to protect and grow their wealth.

That is (along with our fiduciary duty to our clients) what truly defines the difference from good money management over financial advisors (who do not have a fiduciary duty) who make their commissions by touting overly optimistic outlooks and sell their products accordingly. If you did not see the Auditor General of Ontario’s scathing report on the investment industry, I highly recommend it:

“The OSC could better ensure that firms act in the best interests of their clients. In Ontario and the rest of Canada, there is no single rule that requires advisors, dealers and their representatives (dealers) to act in the best interest of their clients. Studies have shown that most investors mistakenly believe that dealers have a legal obligation to act in their clients’ best interest.”

(Click here to go to the report)

Not to be overly repetitive, but this is crucial: “Studies have shown that most investors mistakenly believe that dealers (aka banks and investment industry institutions and the advisors who work for them) have a legal obligation to act in their clients’ best interest.”

Discretionary portfolio managers do have a legal obligation. Huge difference here. High Rock Capital Management is a discretionary portfolio manager. We fall outside of the group known as “dealers”. It sometimes makes the hairs on the back of my neck stand up when some, mistakenly refer to me as a financial advisor. Subtle but enormous difference. But I digress.

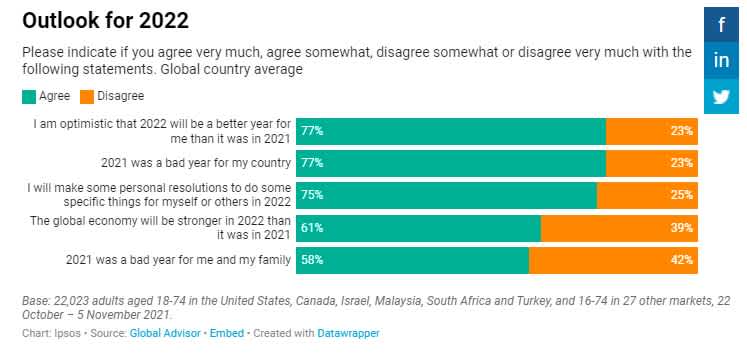

It is, for most of us, in our (human) nature to be optimistic. I will always say that while I will be skeptical of all that sounds too good (like four consecutive years of strong stock market growth, without a major correction) in the short-term, I will be cautiously optimistic over longer periods of time.

Here is how an Ipsos poll found the world’s expectations for 2022:

I learned long ago not to make any predictions for the coming year other than to expect the unexpected, remain hopeful (i.e. hope for the best), but be prepared for the worst. In so doing, also reminding our clients and especially our prospective clients that past returns are never a guarantee of future returns, but that we (at High Rock) will always work our darn hardest to bring our clients and their families the best risk-adjusted returns that we (within our powers of understanding probability and outcome) possibly can.

While it is easy to focus too much on the now, we need to also be planning for the long-term: setting goals and striving to meet them.