If Target (and Costco and Walmart) are any indication, inflation, at least in one sector of the economy, might be peaking and about to fall quickly.

This morning, Target announced, for the second time in three weeks, reduced guidance on their earnings for the 2Q22. On the first announcement, the stock went from about $220 to $150 – a decline of about 32% on the day. This morning, on today’s guidance reduction, it was originally -7.5% but has pared losses to only -1.5% (maybe the market is getting washed out, at least on this stock?).

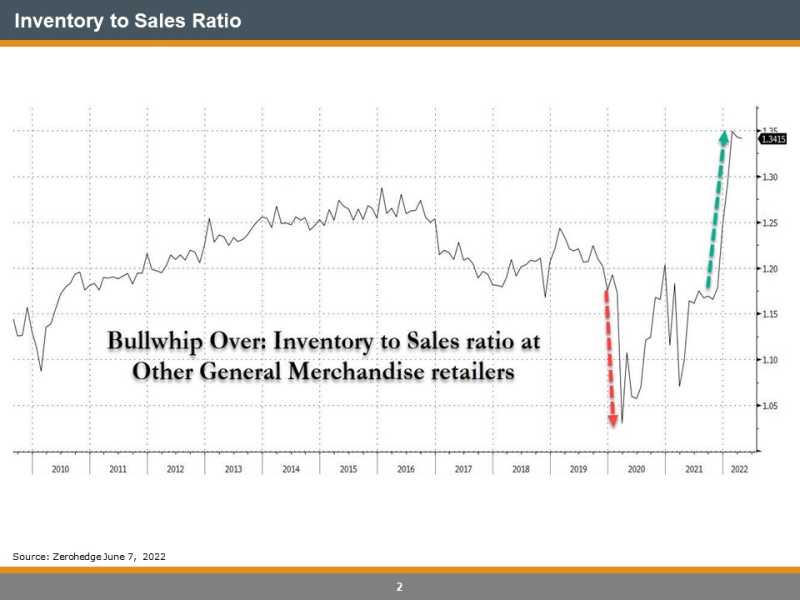

And why is Target’s stock (and Walmart and Costco) getting slammed? Because they are now stuck with excess inventory. And it sounds like they will be putting Red Tag Specials on tons of products to blow out the old inventory and bring that ratio back in line.

Think about the past two pandemic years. All levels of gov’t threw money into consumer’s pockets (even though many didn’t need it) and central banks eased monetary policy like never before. And we consumers were effectively locked down from travel, sporting events, etc. so all we could do was sit at home and buy stuff from Amazon, Target, Walmart, etc. We all became very efficient online shoppers.

But then, as pandemic restrictions began to lift, and consumers, still flush with cash, and new-found wealth in the stock market (up until a few months ago anyway), were able to travel (not very well through Pearson, as I understand it), go to sporting events, concerts, etc. Life experiences over armchair online shopping. The result is the Inventory to Sales Ratio skyrocketing.

What might this mean for inflation? It just might mean it could drop, at least somewhat. There is still going to be a massive cost passed through all levels of the economy due to the energy crisis we find ourselves in and how it passes through not just transportation costs but by the fact that fossil fuel energy is used for far more than just transportation….look at the clothes you are wearing, the keyboard you are typing on, etc. Hydrocarbons go into everything we touch.

Nonetheless, we might see some price inflation relief coming soon and that could allow the central banks to take a pause on these aggressive rate hikes. If so, equities will find a bottom and those which are more interest rate sensitive (the ultimate long duration assets – the so-called FAANMG stocks), may be the best positioned to improve.