It is week three of Financial Literacy Month in Canada (see previous blog). Asset prices are higher (pandemic saving has been re-allocated, driving home buying and stock purchasing), but so are household debt levels (from mortgages which are at record levels). There has been asset price inflation (housing prices and record stock prices), supply-chain inflation and now that the pandemic is expected to ease up on restrictions, consumers are ready (and have begun) to travel, dine out, head out to shows and events, etc.

How do we think that consumers will pay for their new trips, meals, shows and other spending? Clearly it won’t be from expected gains in income (and the government largesse is going to end). They might borrow more, but they may also choose to sell some expensive assets. Likely, they won’t sell the less liquid ones (houses), but they may look to their investment portfolios.

More borrowing in the face of the inevitability of higher interest rates might not be the first choice because the cost to service debt is going to rise. Central banks and financial markets are telling us this. Taking on more debt in light of this may not be so wise.

We have not seen it yet, but if I am expecting sales from assets (especially stocks and it appears that Elon Musk is taking this path, perhaps his “cult” will follow), I bet the debt-burdened government is too. If you do not think that the government (with the NDP at the ready to tax the “wealthy” and perhaps having enough influence to push it) is sniffing around the capital gains equation (i.e. stock sales equal revenue for them, more revenue if they increase the capital gains inclusion rate to 75% from 50%), think again, carefully.

OK, lets recap:

1) More consumer spending without income to support it

2) Price inflation (however transitory?)

3) Asset Price inflation

4) Higher interest rates

5) Higher capital gains taxes (potentially)

Is that the makings of a perfect storm for stock markets?

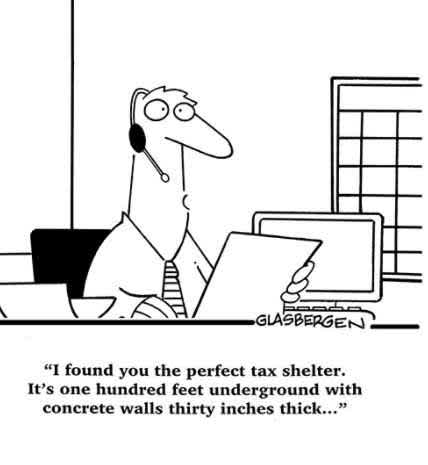

If you can, pay down debt (to avoid higher interest rates) by selling over-priced (non-tax sheltered) assets (lock in profits) before capital gains taxes become more expensive (the government takes more of your profits) and before everybody else starts to sell. If you have not done so, make sure that your TFSA contributions are maxed: The maximum amount you can put into your TFSA is $6,000 for the 2021 calendar year. If you have never contributed before and turned 18 in 2009 or earlier, you may contribute a lump sum of $75,500.

And perhaps have a little less exposure to the stock market?

At High Rock we and our clients are prepared. And we are standing by to help those who want to be prepared!