Oil tends to grab most of the headlines with regards to fossil fuel energy, but natural gas should not be forgotten.

Although oil has climbed from ~$48 to $70 YTD (~+46%), natural gas (Nymex in the USA) has climbed from $2.55 to $5.25 YTD (~+103% – as per chart below).

Why has natural gas, in particular, improved so dramatically and what is the best way to get exposure and profit from this move in pricing?

Why?

Natural gas is largely a by-product of oil production. In some cases, it is not the main focus for those production companies so, if they ramp up oil production, so goes natural gas production. In other cases, however, natural gas is their main product. Over the past 5 years or so, as capital gravitated away form fossil fuel investments and towards (expensively valued) renewable investments, production (of both oil and gas) sank, which ultimately has now led to pricing of both oil and gas rising. The key now vs previous cycles is that these fossil fuel energy companies have “found religion” and are delevering their balance sheets, rather than quickly increasing production. This lack of quick production increases and the focus on delevering their balance sheets with their new found free cash flow, ensures oil and gas pricing remains solid. If you want a more in-depth explanation of this current dynamic, watch this 37min video we did back in March 2021 with a focus at the 11:06min mark with the circular infographic. This is a new paradigm that we believe will continue to lead to a solid oil and gas pricing environment. https://www.highrockcapital.ca/media/high-yield-energy-bond-webinar

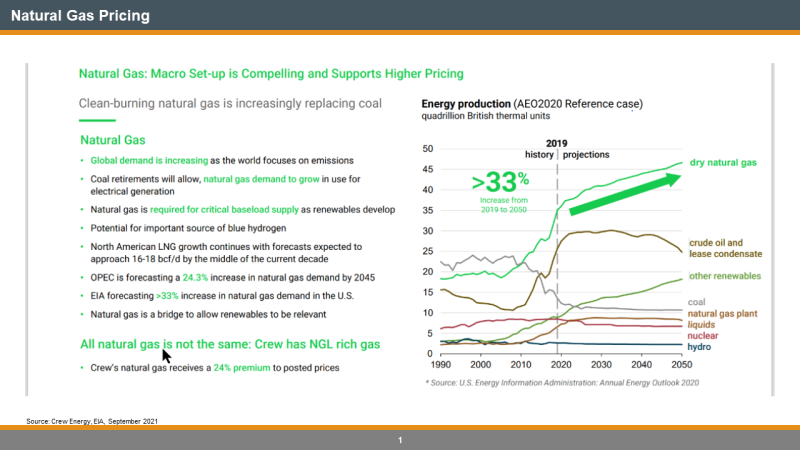

A second reason why natural gas pricing has improved so much is simply related to the forecast demand for natural gas for the next 30 years as the “clean burning bridge transition fuel” to get us through to sustainable renewable energy production, storage and usage in 2050 (transitioning from one energy source to another doesn’t happen overnight – it can take up to 150 years historically, but let’s hope it is a lot quicker than that). OPEC is forecasting a 24.3% increase in natural gas demand by 2045 and the EIA is forecasting a 33% increase in natural gas demand by 2050, which represents almost 3x the consumption in Btu’s than wind/solar in 2050 (US EIA Annual Energy Outlook 2020). As a Canadian Natural Gas Producer (Crew Energy) points out:

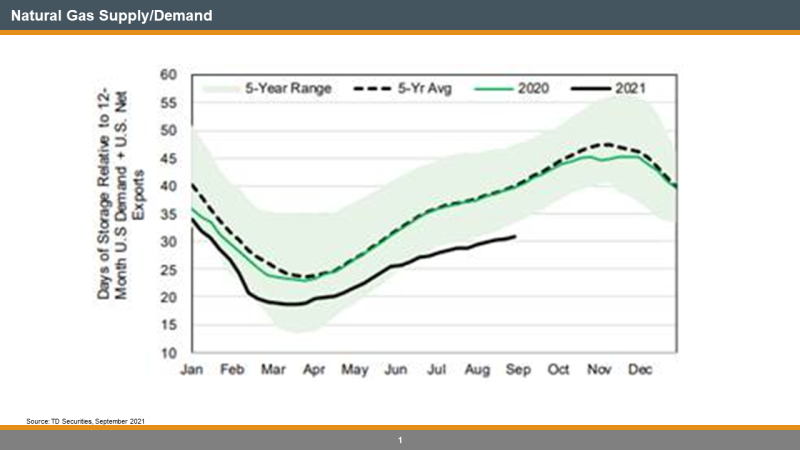

And as TD Securities just published this morning in a report, the days of supply vs the last twelve months of demand plus exports is far below the 5 year average (follow the solid black line):

And what is the best way to get exposure and profit from this move in pricing?

You will have to contact us to find out.

And the picture is to remind us to enjoy what little warm weather we have left this season (and that natural gas is likely going higher this heating season…)

Paul Tepsich, CFA 416-642-5707