Not in any particular order and, by no means exhaustive (message me more, if you like), here are some “firsts”, or at least some events that haven’t happened in a long time. And, as capital markets are reflecting, these “firsts” are a lot to contend with:

1) Ground War in Europe: 80 years

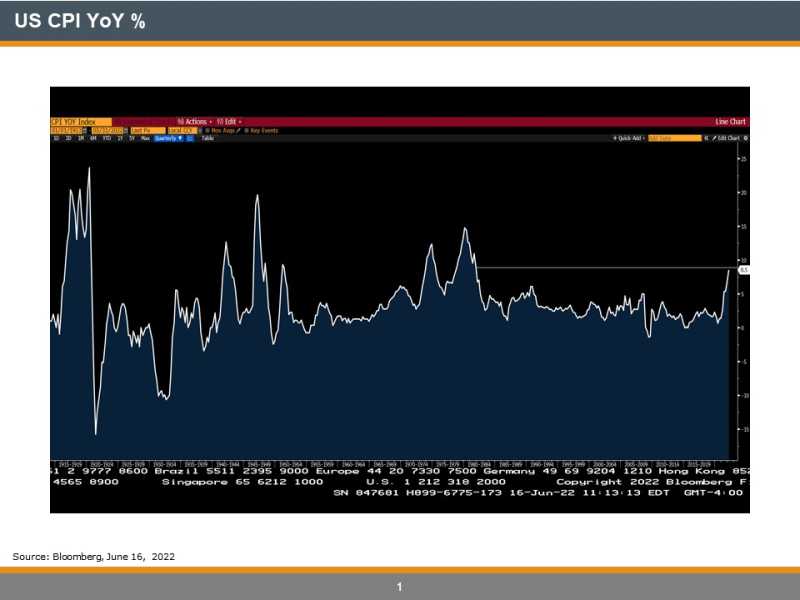

2) Inflation: 40 years

3) Pandemic: 100+ years

4) Fed Funds Rising by 75bps at One Meeting: 1994 / 28 years

5) Tightening Monetary Policy in a Bear Market: never before has the Fed done so

NASDAQ = -33.70% from recent high

S&P 500 = -23.50% from recent high

Fed Funds = +25bps Mar/22, +50bps May/22, +75bps Jun/22 (to 1.50-1.75%)

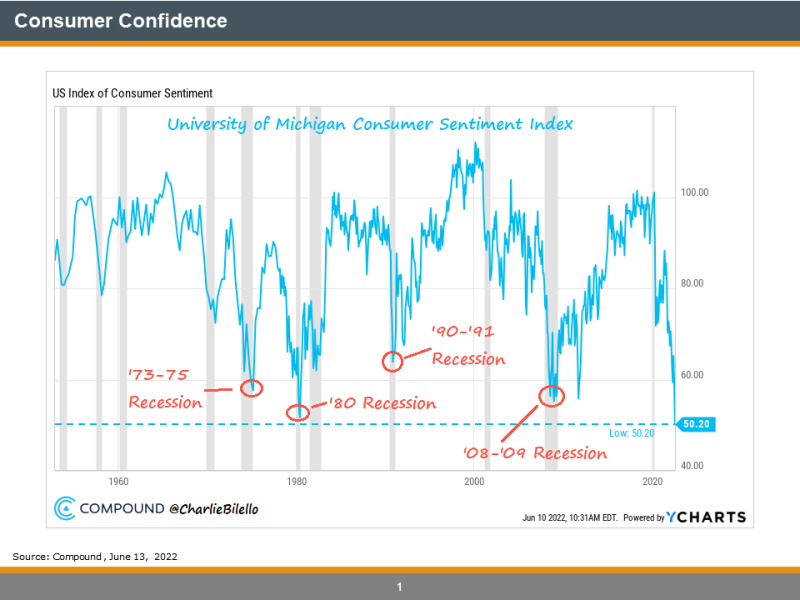

6) Consumer Confidence: lowest since data began

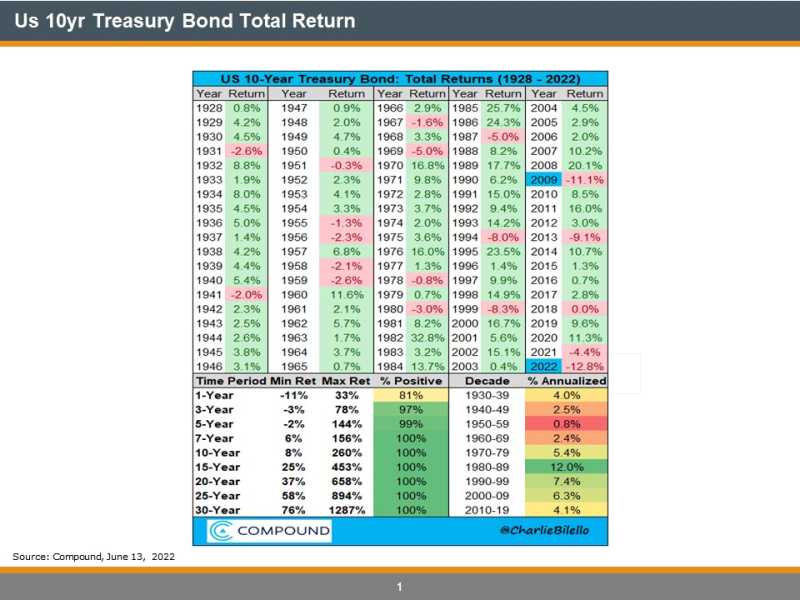

7) US 10yr Treasury Bonds: worst total return ever

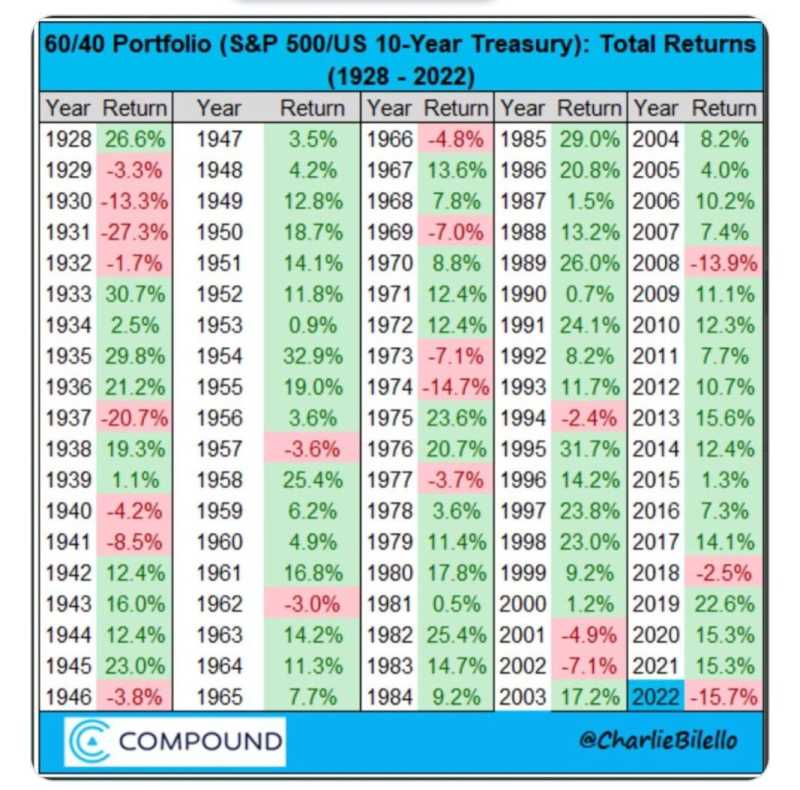

8) Balanced Portfolios: worst since 1937

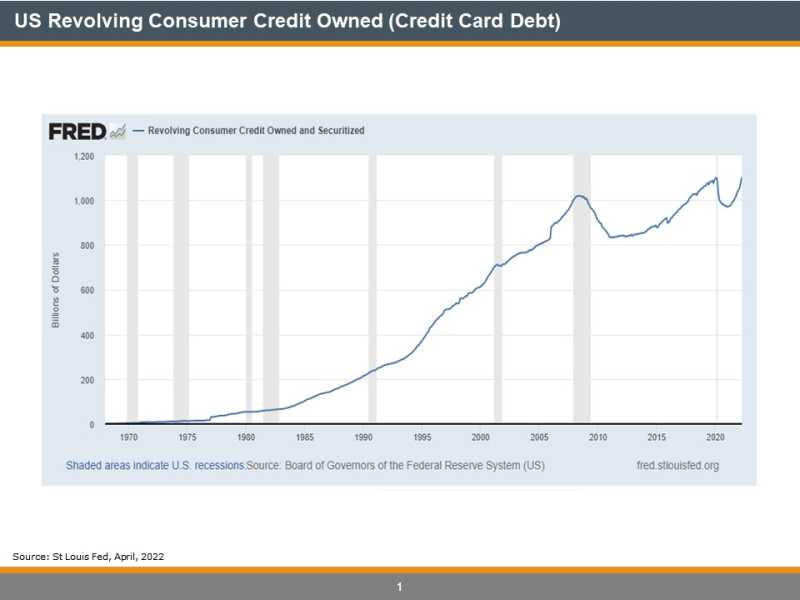

9) Credit Card Debt: highest ever

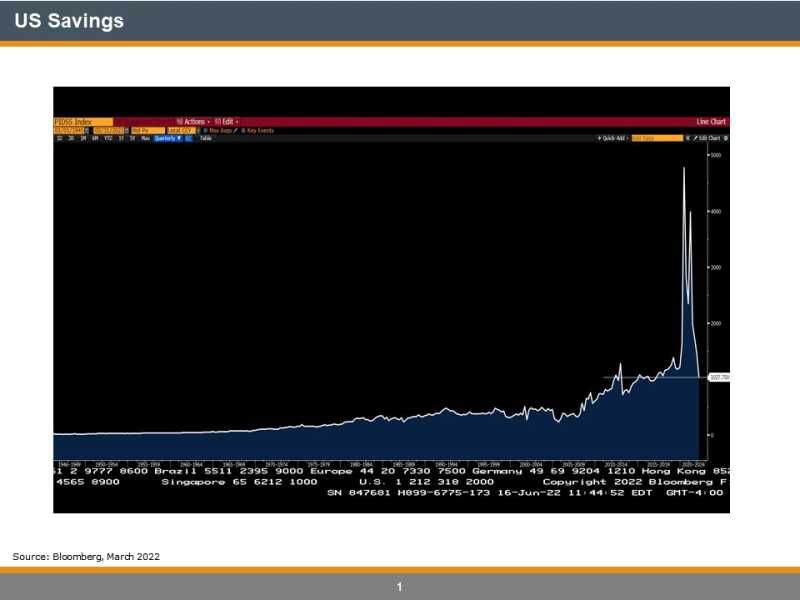

10) Savings: low last seen in March 2017 but after being extremely high (~5x today’s level)

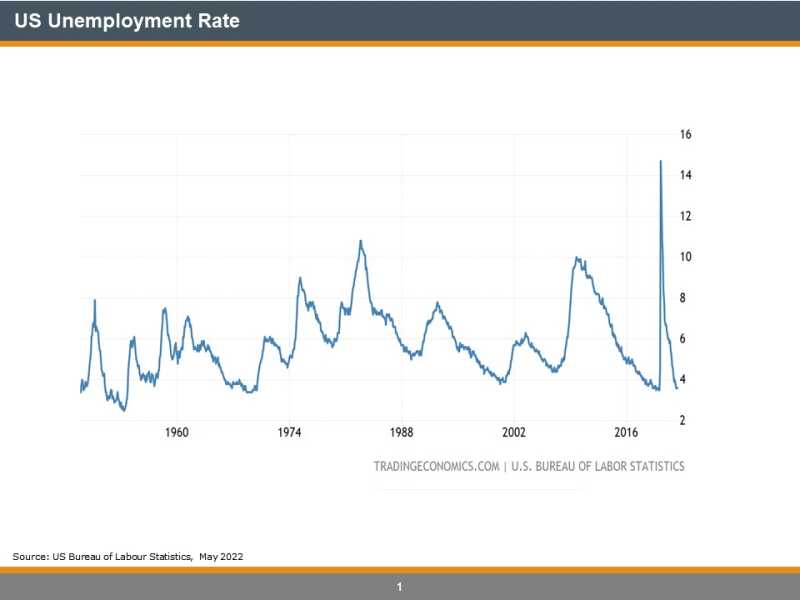

11) Unemployment Rate: lowest in 50-odd years

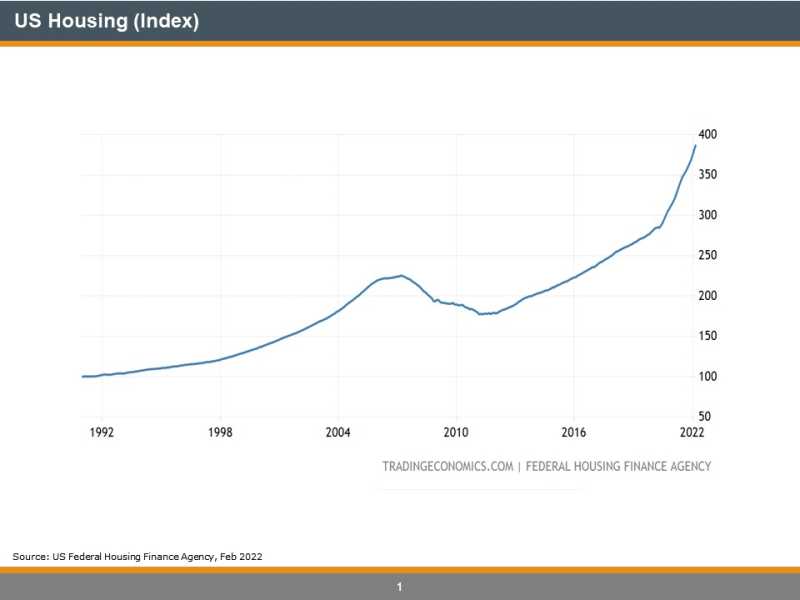

12) Housing Prices: say no more

So, how do wealth management firms manage the risk of all these “firsts”? Carefully. There haven’t been a lot of places to “hide” from the carnage. There have only been a few investments that have worked well the past few months: long Energy stocks (and bonds), Preferred Shares and Cash. Gold and Silver have been sort of flat, so haven’t hurt performance. And recently (the past week) even energy is succumbing to the selling pressure.

At High Rock, we have been fortunate (lucky/smart) to be long a lot of cash since this debacle began. Cash doesn’t make you money, but it sure does help limit losses when the floor falls out, like it has been the past couple of months.

Our current view could best be summarized as:

- Every recession the past few decades starts with the Fed raising rates and this will likely be no different, unless they figure how stickhandle out of it. Read here

- There is (was) a huge wealth effect in stock markets (and residential real estate) that, if it evaporates too much, will lead to a brutal recession as consumer confidence is already at record lows

- This brings about the question of where equity markets need to be for the so-called Fed Put? Best guess might be the S&P 500 at 3400 (at this pace, only about two days away!) which is about -30% from the highs but our sense is it is likely lower (3200 area / -35%) Valuations matter as much or more than the outright level

- Inflation may start turning lower shortly due to an inventory adjustment that has to occur (see blog here) due to the inventory/sales ratio skyrocketing. Not to mention that pretty much every commodity (save for oil and gas) are well off their highs

- If inflation starts abating slightly, we think the Fed may start making statements about slowing their pace of rate hikes

- Eventually the Fed will cut rates again (that is how recessions end), but that might not be before a recession takes hold

- If there is a recession, it will likely be shallow and narrow due to the Fed micro-managing the economy/business cycle, especially during US mid-term elections this November and then the primary election in 2024

- The Fed is the oil in the machine. When they are raising rates, they are not to be fought. We need to wait for a signal from the Fed that they are at least slowing their pace of rate hikes. No time to be a hero, but Warren Buffett has some saying about “buying when everyone around you is filled with fear or losing their heads”

- Mean reversion matters. What has been badly hurt the past year, may perform next year (see points 7 and 8 above)

With that view in mind, and knowing we can never find the bottom, we pick away (small) on big down days, which there are plenty of. To pick our buy targets, we use a combination of fundamental value, technicals on charts and flows. This small adding process goes across our three Models (Fixed Income, Global Equities and Tactical). In Fixed Income, we are getting more comfortable adding some interest rate risk (government and investment grade corporate bonds). In Global Equities, we are adding across our Model on big down days with a focus on the most beaten down US sector. And in our Tactical Model, we are focused on Energy/molecule producers ( Read here) and companies with strong Free Cash Flow that trade at a cheap valuation and have the ability to take advantage of this downdraft with debt reduction and, in at least a few cases, share buybacks.

The past two years or so, we used to say “Stay Safe” from Covid-19. Now it is from the savage capital markets.