So what exactly is disciplined investing (High Rock’s self-imposed mandate)?

First and foremost it involves plenty of analysis and research. Whether it is the global macro economic and political environment, the stock market sector or asset class, the duration (bond maturity dates) or the individual companies that we invest in. Ours is about the continuing search for value: Is it cheap? Is it expensive? Are the risks of ownership too high?

Secondly, but also importantly, it is about avoiding the noise, the hype that so many who already own an investment or asset want to see the price go higher and are very vocal about all the great reasons to own it. The supposed “great tip”. What I, from time to time, refer to as the “cheerleaders”. Does Bitcoin (or any crypto currency) come to mind? Cannabis companies? What has more recently come to be known as “the narrative”. The narrative is created for one reason only, to sell you something.

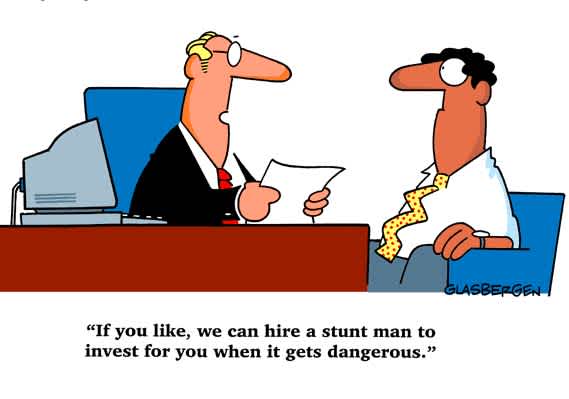

Thirdly, it is about the management of the risk of owning assets. We all have to take risk if we want to grow our money faster than the rate of inflation. But knowing what that risk is inside an investment portfolio is absolutely paramount to successful investing. Each asset adds an element of risk separately, but a diverse selection of assets can greatly lower the risk, as well as the allocation of those assets (% weight or under-weight /overweight). So can knowing when to hold cash or cash equivalents (as a defensive measure).

I have had many conversations trying to help clients and client prospects to navigate around unrealistic expectations. Often times, especially in the short-term, my advice goes for naught. However, over time, realities come home to roost and those that heed our disciplined approach are rewarded.

The pre pandemic era of investor enthusiasm (as the economy was closing in on the late stage of the cycle) was crushed by Covid, but the response of monetary and fiscal authorities never permitted the cycle to meet its natural fruition. As a result, investors came to the conclusion that they were invulnerable (despite my repeated efforts to tell them otherwise). The real nature of over-tinkering (by governments and central banks) is now come home to roost and investors, even with the most balanced portfolios are suffering the excesses of bursting asset bubbles. The wealth destruction has been enormous and the repercussions have yet to be completely felt.

In time, this will pass (there will be plenty of value created as prices continue to fall). However, staying disciplined will always be reason to sleep better at night.