In a late July letter to the institutions that regulate Canadian securities laws and practices from FAIR Canada (a national, independent charitable organization dedicated to being a catalyst for the advancement of the rights of investors and financial consumers in Canada) on cost disclosures provided to investors, I noticed a February 2022 study by Mercer (the financial consulting folks). The study suggested that the “analysis of various investment management fees in the market found that a representative individual paying the median level of fees available to the individual investor” was 1.9%. What? Who (knowingly) pays that for investment management? It also means (as it is a “median” level) that some investors pay more than that.

The Mercer study basically suggests that if you pay those kind of fees, you are extending your need to work by a solid 4 years. And then, what about the 30 to 40 years after you have finished working? The fees you pay compound, negatively, toward the average annual rate of growth of your investments, reducing the ability for you to grow your money.

If you are paying that much, it better be worth it.

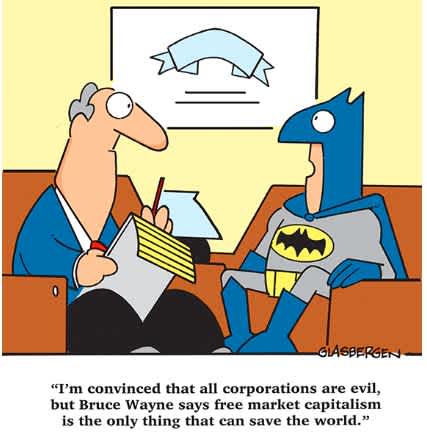

The thing is, I know, from over 20 years of wealth management experience (some as a branch manager, watching “advisors” do their thing) that few investors get what they pay for. In most cases, they are getting too much risk, no fiduciary duty (so lots of potential conflicts of interest) and less than optimal service.

When we started High Rock’s private client (wealth management) division, over seven years ago, we set about to be a leader in an industry underscored by very dubious intentions and enormous conflicts of interest (see the Ontario Auditor General’s report from December 2021 or read my blog Here Comes 2022). Fee transparency was high on our list. But not only the transparency, but the actual costs themselves. Back then the median cost to investors may have been well above 2% (and it was well disguised in many cases) and we were cutting that in half, at least.

Our Canadian banks and other financial institutions have garnered the trust of their clients with broad marketing schemes that paint them with the best of intentions while they over-charge their clients for the benefit of their shareholders. Then they self-regulate with a pretense to saying that they want to protect investors and then turn around and fight “tooth and nail” behind the scenes to protect “bad” advisors. As well, they heavily lobby other regulators to stall initiatives that might indeed be beneficial to investors, but also end up costing them revenues. I have seen this personally and so has the Ontario Auditor General, and yet it continues.

FAIR Canada is fighting the good fight, albeit a steep uphill battle, to protect investors from the hungry wolves looking for a meal. High Rock is too. Time to ask the big questions (especially in light of a pretty horrific half year for your net worth, although well managed risk, as it is at High Rock, may have had somewhat different and better results): What exactly am I paying for and exactly how much is it that I am paying? If the answers are not clear (or are couched in evasive terminology), get a move on. If you are paying 1.9% (i.e. you are in the “median”), you certainly do not have to be.