Human Behaviour. No matter how we might try to tell ourselves that we know better, we generally are lead into the same traps, time and again. We are captured by the narrative of the day. We fall prey to “group think”, the need to conform to a certain way of thinking that benefits those who have all jumped on the same bandwagon. For a time, it all becomes self-fulfilling. Then, just when complacency firmly sets in, boom, out of the blue comes along what was initially thought of as unheard of: reality.

Low interest rates, loose monetary policy and higher stock market prices (regardless of valuation) was the narrative of the day post 2020 market melt-down. As I have mentioned before, all participants benefit in rising stock markets: investors see their portfolios rise in value, advisors reap increased commissions and the manufacturers and managers of investing product and portfolios all benefit (namely banks and investment dealers). So all have a vested interest in propelling the situation (cheerleading). The seedy underbelly is the inherent conflict of interest: the shareholder and their financial needs become more important than being honest and upfront with the client, who will inevitably be left holding the proverbial “bag” when things start to unravel. The mandatory disclaimer that past performance is not a guarantee of future returns slips into the very fine print and is rarely brought to mention.

That is, of course, until the realization of a change in the narrative.

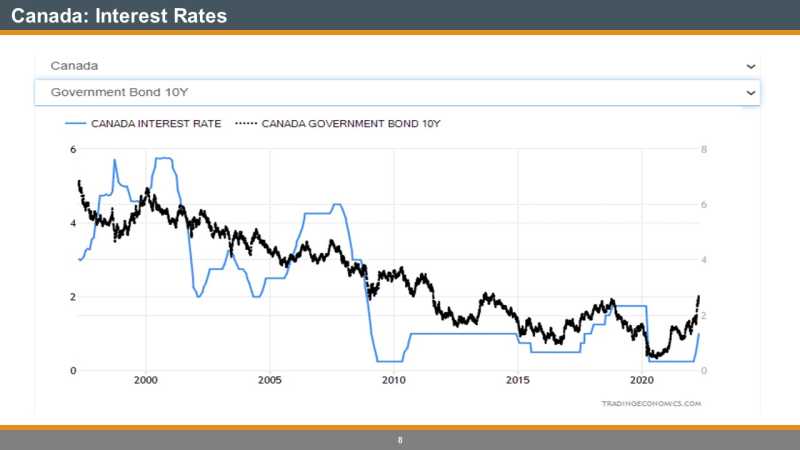

Enter the central banks who waited too long to address the bubble in asset prices and the inflation that popped post-pandemic. As I suggested at the end of 2021, interest rates were going to go up. They are probably going to go up too much, especially for the over-extended households (with too much debt) and recession will ensue.

Today the Bank of Canada did something that it has not done in 22 years: raised its interest rate by 1/2%. Although 10 year bond yields had been predicting this well in advance and in fact are predicting a whole bunch more of increases (we know that bond markets lead all other financial markets and the Canadian bond index ETF (XBB) is now down over 9% year to date).

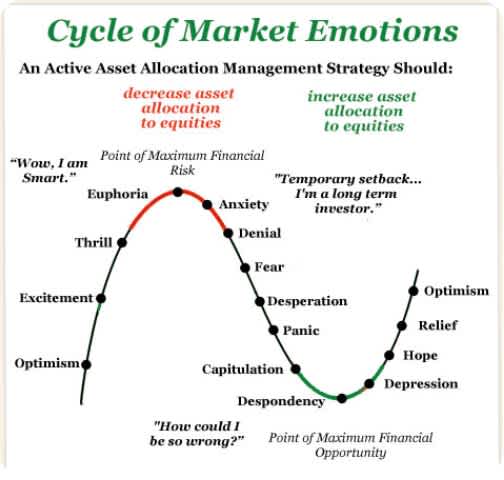

Remember the recessions of 2001-2003 and 2008-09? Some may not. They did not help stock prices. Why would this be any different this time. If anyone tells you that this is a good time to invest in stocks (because they are cheaper than they were at the end of 2021), walk away. They are only trying to revive a narrative that is no longer valid. A last gasp. Denial (and they likely want to sell you what they don’t want anymore). The emotions of fear, desperation and panic are yet to come. Sorry if that sounds harsh, but we need to be building in some reality about what is to come as central banks continue to tighten monetary policy. Stocks are not going higher any time soon (other than in short-covering, technical trading when markets signal “over-sold” conditions).

In the meantime, at High Rock we will be honest with our clients, tell them to expect some bumpy portfolio valuations over the course of the next six months to a year (we do always disclaim that past performance is not a guarantee of future returns, but that we will work darn hard to get them the best possible risk-adjusted returns) and when panic turns to capitulation, we shall be ready with our and our client’s cash (which we raised as we re-balanced portfolios) to put to work.

Until then, we wait. Patiently.