By now, everyone has a very darn good idea about the inflation we are all paying for in just about everything we buy and consume. Over the past two years, there have been many memes on the inflationary topic of the day…”even up swap of a F-150 pick-up truck for a sheet of plywood” to “someone who can fill up their gas tank and buy groceries on the same day is rich”. It is now everywhere in our society as it travels through all levels of the supply chain. And this was happening long before Putin decided to invade Ukraine – that just made it worse.

And as a refresher, I wrote a (long) blog mid-January that you are welcome to read again: here.

Reading news the past week in both Canada and the US, it would appear that deficit financing will not only not subside, with the pandemic largely over, but may even increase, certainly from rational expectations.

Cause:

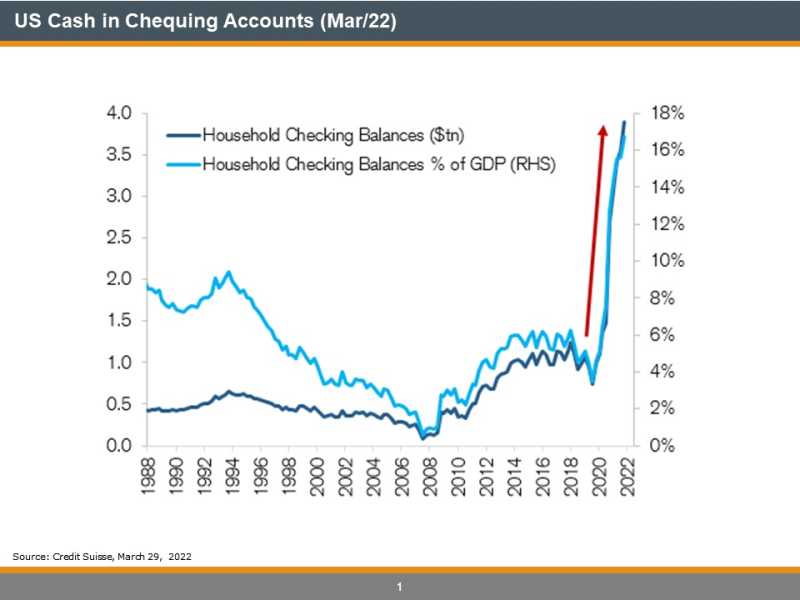

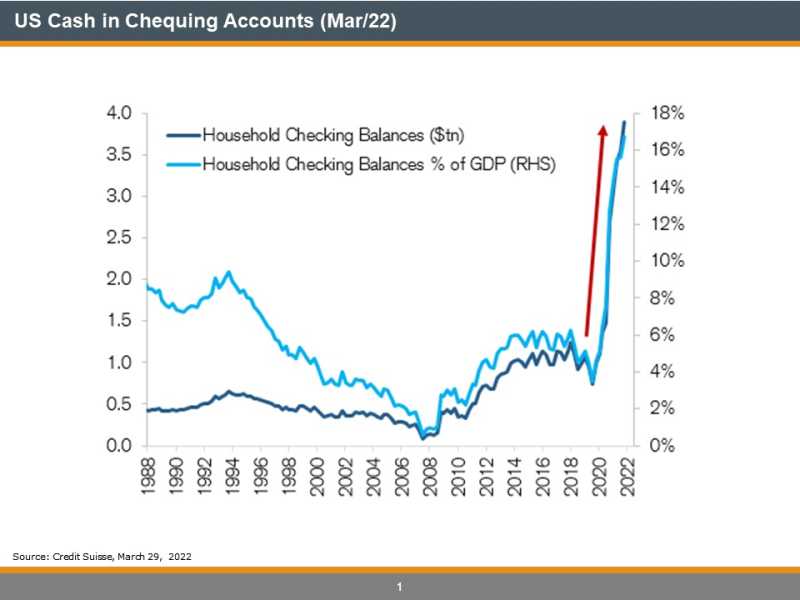

Have a look at what has happened to US Household Chequing Accounts over the past two years. All those so-called “stimmy cheques” being put into the jeans of consumers/voters.

Effect:

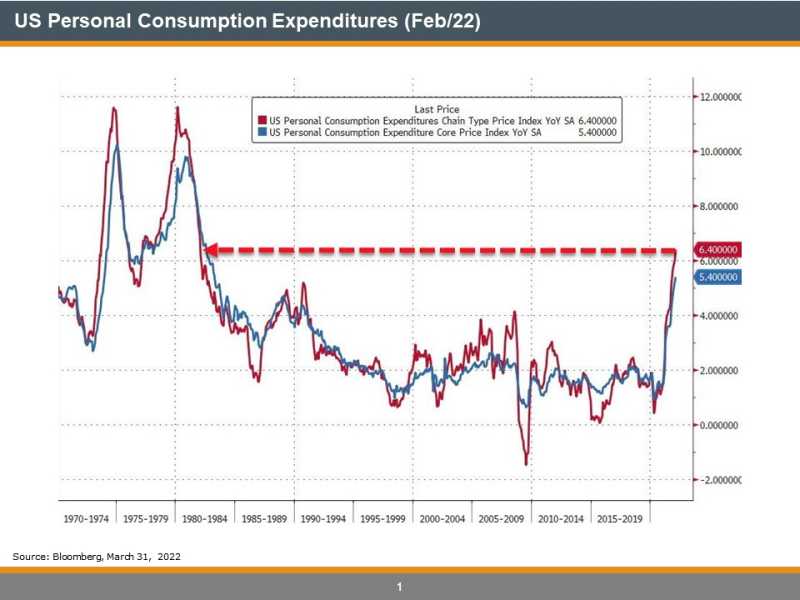

Today, the US just released their Personal Consumption Expenditure numbers, which just happens to be the Fed’s favourite measure of inflation.

Yikes. We have to look back to about 1982 to see when it was last at +6.4% yoy.

As I said to a neighbourhood friend last week, “it is a tragic shame that these deficits are meant to help those who are least able to afford them. We are all paying for the effect of these deficits but those who can least afford to are the most affected”. And as another friend of mine said to me a month ago, “I have the bandwidth to fill up my 145L pick-up truck tank and buy my steaks at Summerhill Market”…lucky him because most people don’t.

I conclude with a quote from arguably a man who is/was recognized as the smartest in the world: “The definition of insanity is doing the same thing over and over again, but expecting different results” ~ Albert Einstein