Throughout the investment / economic landscape, there are always a series of evolving narratives that become the catalysts for investment ideas and / or get rich quick schemes. We should always look at these with a healthy degree of skepticism or just plain downright suspicion. Inevitably, there are always ulterior motives at play, planted by “advisors” in order for them to sell us something and rack up revenues and commissions for doing so. Our long-term planning (Wealth Forecasting) can get challenged by these new and apparently exciting opportunities (shiny objects) which may distract us away from the boringly slow grind of gradual growth and long-term compounding.

The inflation narrative has popped up recently and this has become one of the latest issues, as advisors, once again decry the fixed income component of a balanced portfolio as bond yields rise and prices decline. Many balanced mandates were flat through the first quarter of 2021 with the rise in stock prices being offset by the fall in bond prices allowing advisors to get giddy with ideas for selling the fixed income asset class (that saved many balanced portfolios in last March’s freefall) in favour of buying more and expensive equity assets generating commissions for themselves and putting their investors at greater risk. If that is not conflict of interest, I am not sure what is.

A time for a healthy dose of skepticism.

So what is this inflation concern that has bond markets worried? When Covid hit and economies were shuttered, demand for goods and services dropped significantly. Supply of goods and services had to be curtailed as well. As economies gradually started to re-open (and central banks and governments continued to stimulate growth), demand returned, but supply lagged (temporarily). Until supply catches up with demand, there may be some upward pressure on the prices for these goods and services and this is the inflation worry that spooked bond investors, who wanted a bigger inflation premium built into bond yields. However, without wage inflation to push price inflation, the increases will be transitory. With employment returning at a much slower pace, the likelihood of wage inflation is minimal. Even pre-Covid, with unemployment at multi-year lows, there was no wage inflation. It is not likely that it will make a significant comeback, so we can be somewhat suspicious of an advisor selling us on this inflation narrative.

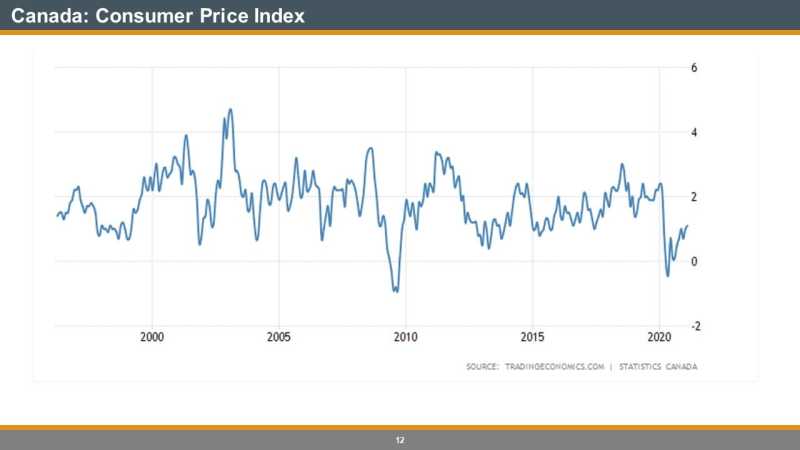

Year over year inflation in Canada is running at about 1.1% currently, well below its long-term average and well-below the Bank of Canada’s target. Bond yields (longer term interest rates) may have risen. However, the Bank of Canada, whose mandate is price stability, sees little inflation risk, otherwise they would be starting to raise shorter term interest rates.v

Importantly, if, as we do in our Wealth Forecasts, we use a relatively conservative (on the high end) annual increase in our cost of living assumption of 2.5% and we are able to grow our net worth annually by 4.5%, the “real” rate of growth is 2% annually. If however, as has been the case, the cost of living (consumer prices) only increases by 1%, our rate of growth of our assets remains at 4.5%, we are actually experiencing a “real” rate of growth of 3.5% for our net worth. That strikes me as reason to take less risk, not more!

More healthy skepticism: most Canadian’s perceptions are that the consumer price index as reported by Statistics Canada is not their reality. So the Bank of Canada did some work on that particular topic in their report “Toward 2021: Renewing The Monetary Policy Framework”

“In 2021, the Bank of Canada and the federal government will renew the agreement on Canada’s monetary policy framework. To inform our discussions, the Bank conducted a broad range of public outreach activities between 2019 and 2021.”

Appendix 6: Inflation—perceptions versus reality:

“Surveys conducted by the Bank of Canada show that many consumers perceive inflation to be higher than its measured level and its target. As part of the Bank’s research for the 2021 inflation-target renewal, we wanted to test the accuracy of this perception and to better understand it.

The inflation rate that guides the Bank’s decisions is the consumer price index (CPI). Statistics Canada uses the CPI to track:

How much the average Canadian household spends. How household spending changes over time.

Using its Survey of Household Spending, Statistics Canada estimates what an average household includes in its “shopping basket.” This basket includes about 700 goods and services that Canadians typically buy.

Working together, Statistics Canada and the Bank tested consumers’ perceptions that inflation is higher than the CPI. To do this, we constructed a shopping basket and inflation rate for different groupings of households based on:

Income. Education. Age. Whether they are renters or homeowners.

We found that the inflation rates constructed for specific consumer groupings were similar to the measured CPI inflation rate.”

You can also visit the Statistics Canada site to dig a little deeper, if you wish.

The key point is: what is our current annual increase in our cost of living. How does it now and how will it in the future impact our long term objectives. More importantly what level of risk is necessary to achieve a rate of growth that will continue to keep us ahead of the annual increase in our cost of living to make sure that we don’t see our purchasing power erode. If someone tries to sell you more risk, based on a narrative that is the order of the day, make certain that you have a darn good reason to take it on. Make sure it fits with your plan.

Any references to rates of return are purely for illustrative purposes. As such, regardless of what any one else tells you, past performance is not a guarantee of future returns. As you all know, we at High Rock work darn hard to get our clients the best possible risk-adjusted returns.