As I write this (the first in some time), stock markets are looking to open down about -1.75% just this morning. This follows on the heels of a -1% loss on Friday and with the S&P 500 at 4355, lower by about 4% from its early September highs. Welcome to volatility, again.

What happens next will be particularly crucial: if stocks drop enough to trigger margin calls (where lenders ask clients for more cash to cover their borrowings for buying stocks), further selling may materialize (in order to generate the cash). Selling in Bitcoin overnight sees its price down close to 10%, possibly in anticipation of those margin calls.

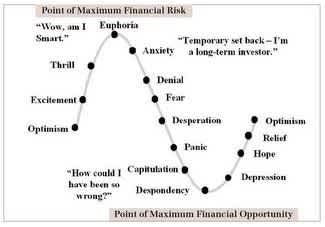

That would likely cause a snowball effect and push volatility up and stock prices lower. something to be prepared for, mentally and emotionally:

Then again, if there are any buyers left and there is enough “buy the dip” ability still around, some may be enticed to do more buying and steady prices. If there is not, then I fear that this correction may have more teeth. So be prepared for that potential too. If you are a “buy and hold” investor, just understand that this may get a little uglier before it gets better and the time to return to “record highs” may get stretched out to years as opposed to months.

If short term swings in portfolio value cause you to lose sleep (especially if you are dependent on your portfolio for your lifestyle expenses and cash flow), perhaps a professional and disciplined portfolio management team will help in the sleep deprivation department? At High Rock our client’s investment portfolios are tailored to meet their specific goals. That means that we manage risk first to protect growth and your valuable sleep. For it is the mistake of many investors to underestimate risk and higher risk (than you might have assumed) can lead to greater degrees of volatility (and for those it bothers, loss of sleep).

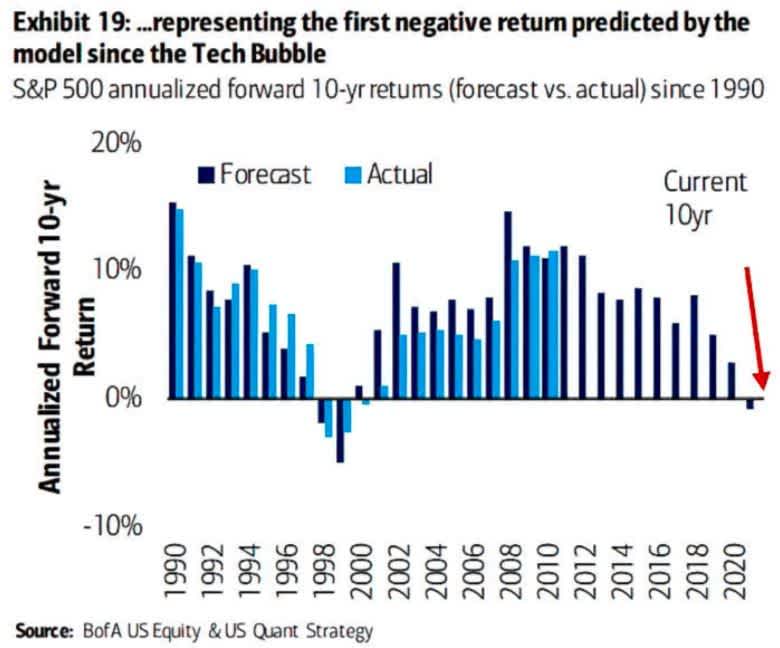

It is especially difficult to discuss risk with investors when their investment portfolios have been growing steadily, despite inflated (and historically speaking, “bubbly”) stock prices. This is actually the best time for a risk assessment, not when it starts to move lower.

It is when markets turn volatile that our inbound communications from new prospective clients (fear does become a factor) rise. Know anyone who needs help? We are standing by.