I was never a patient child, according to my parents, always pestering them from the back seat, anxious to get the long, boring drive to wherever over with. Their response: “we will be there when we get there”. Now we have Google Maps and Waze and other tools to navigate that give us pretty good references for our ETA. Wish financial markets were as predictable?

We do have some tools, but clearly not as accurate.

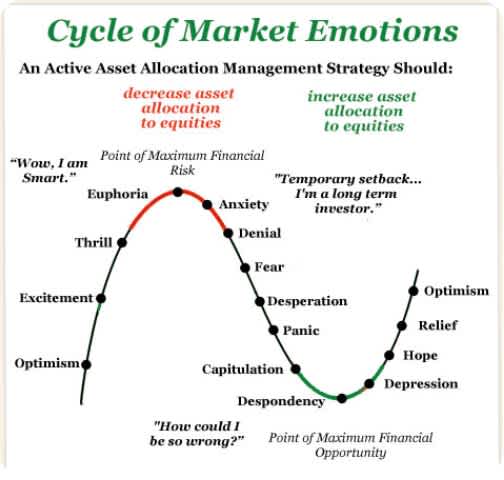

On the behavioral / emotional side, it does appear that we have moved from the “denial” stage to the “panic” stage when we read headlines like: “Investors pulled almost $5-billion out of Canadian mutual funds last month amid market turmoil” from The Globe And Mail this morning. Or is that “capitulation”? Not certain.

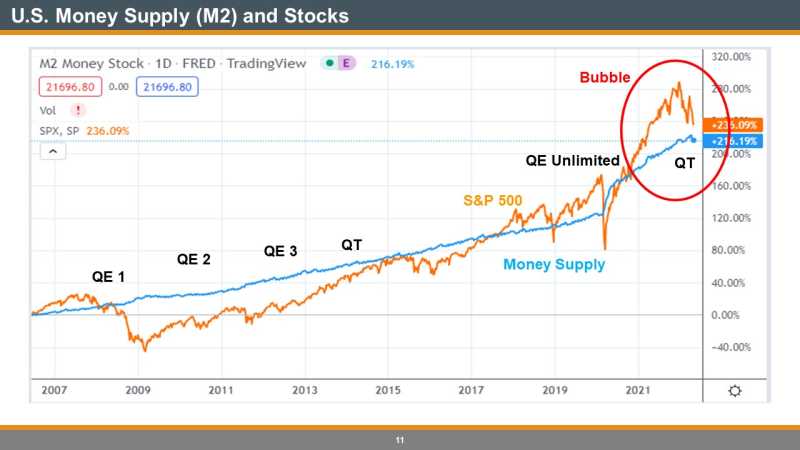

However, it is clear that all those who were buying into the hype when stock markets were running hot (and the cheerleading was deafening), are feeling the anxiety. Not to mention those stuck in the world of crypto or those with recent home purchases with jumbo mortgages. The system was flush with money and all that money was chasing assets, driving the prices higher and bubbling up:

The U.S. Federal reserve “goosed” the money supply (as did central banks around the globe) with quantitative easing (QE) to counter the panic brought on by the pandemic. This was not the light version that helped bring the investing public back after the Great Recession of 2008-09, it was the heavy duty stimulus version (Unlimited QE), because for some reason central banks lost sight of their mandate of “price stability” and let investors / gamblers run rampant. Oh, the tangled web we weave! Now Quantitative Tightening (QT) is in full swing to bring the excesses of monetary stimulus back into line. As the money supply shrinks, assets need to be sold (folks have to pay for their food and gas and rising debt servicing costs) and the snowball gathers momentum as it rolls down the hill.

Where does it stop? Not certain.

However, constant rebalancing of our client portfolios as asset prices rose, means that we have plenty of cash on hand to be buying when we hit “capitulation”, which we estimate at somewhere between 3500-3800 on the S&P 500. It is currently hovering at or about the 3900-4000 level.

Could it unravel further? Possibly. Who knows what the negative “wealth effect” (billions of $ of wealth eroded with falling asset prices) will have, combined with a very expensive climb in the cost of living.

We will get through it, as we have in the past (some have more time to be patient than others) . The governments and central banks tried to manipulate the economic cycle (through the pandemic) and it blew up in their faces. So now, we must face the music that comes with every economic cycle, a recession. A real one. It may be deeper and longer than many of us expect, so, as I always say: hope for the best, but prepare for the worst. That’s disciplined investing. That is High Rock!