A couple of very quick observations.

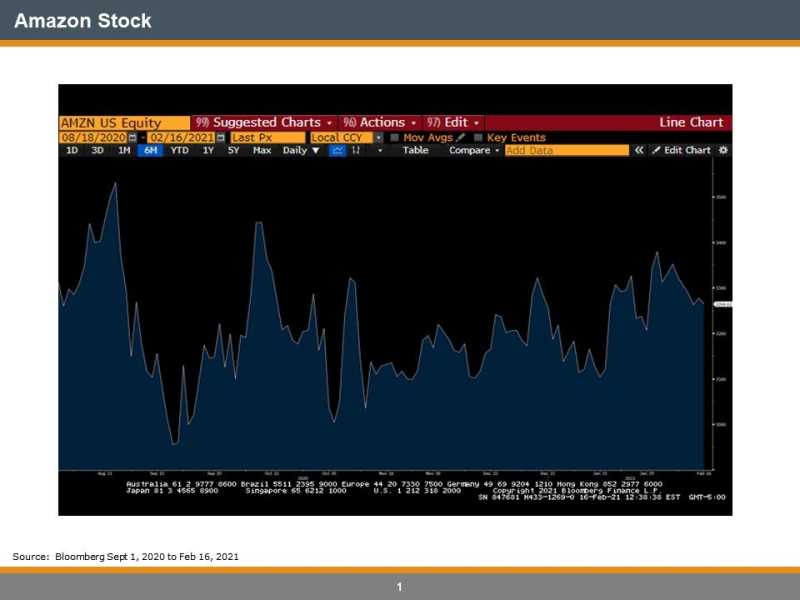

Amazon, arguably the poster child for Mega Capitalization Tech companies, has been volatile for almost the last 6 months. In fact, as of September 1, 2020, the stock is about -6.8% till today. It is probably fair to say that the good news and Covid-19 lift is in the price of the stock.

And AMZN, along with most of the other so-called FAANMG stocks, are considered “long duration” assets as they have high growth ascribed to them long into the future. So when interest rates (gov’t bond yields) were extremely low, the FAANMG stocks were rocking because the “discount rate” (based on gov’t bond yields or interest rates) was very low which provides for better Present Value of those future cash flows.

However, something has changed. Interest rates have now climbed and by a fair bit. The effect on AMZN is seen in the ~-6.8% return since September. As interest rates rise, so does the discount rate…and the stock(s) go down due to the lower Present Value of the future cash flows.

So, a couple of observations/conclusions:

Interest rates, especially in the longer end of the bond curve, have risen sharply AMZN, and other “growth” stocks have not performed well 2.09% on 30yr USA Treasury Bonds is getting to be more enticing, as is 1.30% on 10yrs

Things change, FAANMG stocks will not go up forever and, as is almost always the case, we need to pay attention to the bond market.