In Part 1 we identified 7 risks to achieving your financial goals.

In Part 2, let’s analyze these risks:

1) Not having a steady stream of personal income.

Whether we work for ourselves (highly recommended, but comes with perhaps more potential risks) or for someone else, establishing a stream of income is, especially in our early post-education days, vital to enabling us to start building our future wealth. Not having income will definitely delay our arrival at our goals because it, obviously, means it will hurt our ability to save.

2) Not generating any savings.

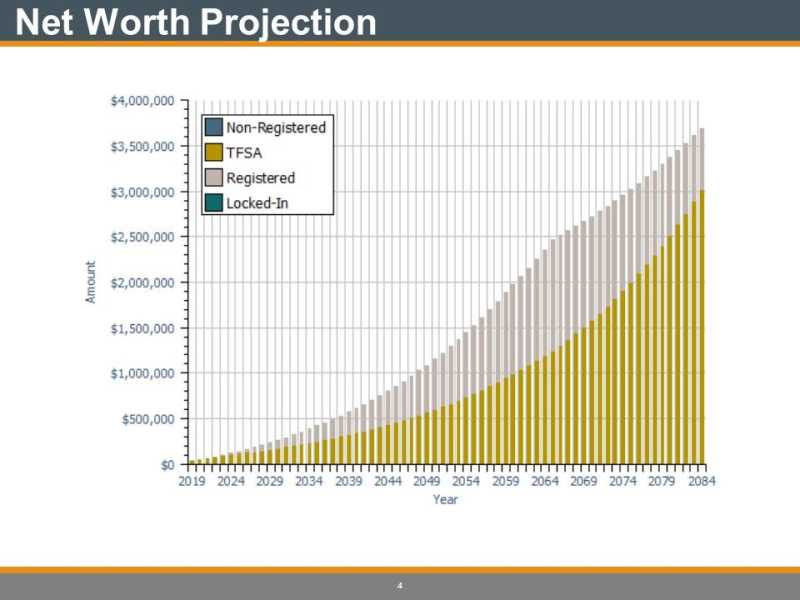

Pictures, they say, are worth a thousand words (below), but if you can begin early enough, the powers of compounding are going to be the “magic bean” that allows you to multiply and accelerate the growth of your wealth. Perhaps see my June 24 blog “New Financial Literacy Curriculum” specifically, Lesson 3: compounding.

But you definitely don’t want to miss out on this opportunity to grow your savings and wealth:

The growth chart above is based on a rate of an annual average growth rate of 5.5% before fees, taxes and inflation and regular contributions of savings. Which means that your income has to be able to cover your cost of living and have some leftover for saving.

Which leads us into the next risk factor:

3) Not getting growth from your savings beyond the annual increase in your cost of living:

As I suggested in Part 1, bank or other financial institution GIC’s and savings accounts are just not going to cut it. When our central banking institutions (The U.S. Federal Reserve, Bank of Canada, etc.) tell us that interest rates are going to remain at or close to zero until 2023, don’t be expecting to get a whole lot more out of any financial institution who wants to use your money to lend to others (and make the spread for their shareholders) at somewhere between 2-5%.

In other words, you will have to find ways of growing your money that will require greater levels of risk. A 90 day Government of Canada treasury bill is “risk free” (as a short-term obligation of the Canadian Government). Currently it pays about 0.15% before fees and taxes. Anything that pays more is going to have some level of risk attached to it. No wonder investors are jumping into the stock market with very little idea of how much risk they are actually exposing themselves to.

Therefore… Risk #4

4) Investment asset price depreciation.

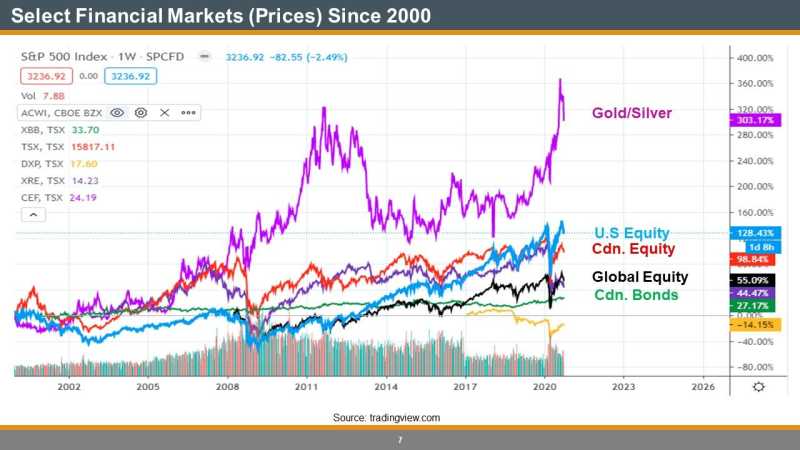

Stock prices as a broad asset classification, over long periods of time, generally go up.

U.S. Equity (S&P 500 stocks) have returned price appreciation of 128% since 2000, or an annual average of 6.4%. Add the average annual dividend yield over this time period and the total return has been around 7.6% annually.

But they can fluctuate wildly at times. Most of us were watching what happened in March of this year. When you see that kind of volatility, it can be rather disturbing.

However, the central banks have figured out how to entice us back in by making “safer” alternatives so unattractive that some believe that there is little other alternative (at the current time) than to be invested in stocks, driving stock prices to somewhat extreme levels.

However, with little or no economic growth expected until 2023 (from current levels) and corporate earnings likely to offer little growth, what is the true value for stocks? A very important question for investors. If they are overvalued at current levels, then there is the possibility of price devaluation in front of us. For some (with shorter time horizons for reaching their goals) that may be daunting and carry too much risk. So it ultimately becomes a function of what your specific goals are and the time allotted for achieving them.

For those who need steady cash flow into their investment portfolios, there is risk there too.

5) Investment asset income interruption

Lower interest rates for longer periods of time will mean that safer methods of deriving cash flow for investment portfolios are going to be affected. Investors who need “yield” will have to look at other, potentially higher risk alternatives. In the bond market, the safest bonds, issued by the Canadian or U.S governments yield between 0.55% to 0.70% for 10 years. Investment grade corporate bonds (like banks, insurance and telecom companies) are 1.5% to 2%. It may require some further venturing into the higher yield, higher risk bond world. Preferred shares, with higher dividend payouts have been exceptionally volatile through this time.

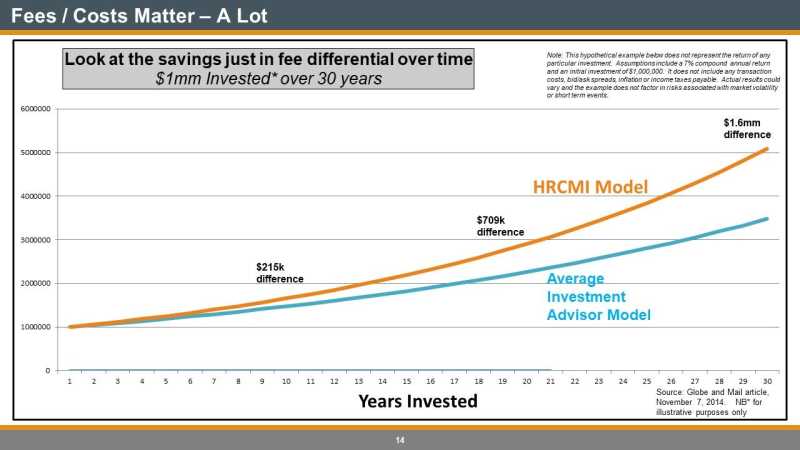

6) The costs associated with investing.

Fees, commissions, MER’s (Mutual Fund Management Expenses) can all eat away at your long-term portfolio growth (eroding the magic of compounding effect) and make it more difficult to get to your end goals:

7) Taxation

Taxes, in our lifetime and likely for generations to come are not going down following the staggering debts and deficits that have been created in response to the Covid pandemic. In fact, expect governments to try to find ways of further taxing the wealthy (non-registered assets and capital gains). We have to be prepared to face this risk in the accumulation of wealth.

So what do we do about all of this risk?

Stay tuned…