Sadly and unfortunately we see these situations far too frequently: (from the Globe and Mail, March 24, 2021) “”It’s a broken system” investors face regulatory nightmare after adviser’s moves trigger big losses”.

” In 2012, John Flynn was trying to get his family’s finances in order for retirement. After working for 38 years as an engineer in Alberta’s oil fields, most of the Flynns’ savings were tied up in oil and gas stocks. They needed a standard retirees’ portfolio – diversified, low-risk investments with enough income to live off. After meeting with their new financial adviser, who came highly recommended by a friend, the Flynns felt like they were in good hands.

It wasn’t long before they started to notice big losses in some of their new holdings, particularly in what they were told were safe corporate bonds. It turns out these were actually highly speculative debentures issued by junior energy companies that had a substantial risk of defaulting. Plus, they were illiquid, meaning investors couldn’t sell them at will.

Those and other investments would end up costing the Flynns nearly $500,000 from the nest egg that they’d spent decades building up. “It was very scary. Here I am in year one, year two of retirement, and a considerable stake was just gone,” Mr. Flynn said. “And let’s face it, it’s embarrassing. You trust someone … .”

Mr. Flynn’s determination to get his money back would plunge him headfirst into the Canadian securities industry’s complaint-handling system, which investor advocates have long criticized as tilted heavily against the everyday investor.”

Mr. Flynn jumped through all of those hoops only to have his complaint rejected at every stage. It would take nearly five years before the full picture would emerge of just how misaligned the family’s financial plan was for their stage of life. Their entire portfolio was allocated to high-risk investments, most of which were concentrated in energy sector holdings.

Only after getting a lawyer and initiating a lawsuit did the Flynns come to an undisclosed agreement with Richardson GMP, his adviser’s former employer, in May, 2020.

It shouldn’t be that hard, or take that long, for legitimate complaints to receive a fair hearing, said Harold Geller, an Ottawa lawyer who represents investors with claims against their advisers, including Mr. Flynn. “It’s a broken system, which relies heavily on the industry to abide by the basic principle of treating clients fairly, honestly and in good faith,” Mr. Geller said. “At times, I think they ignore that obligation.””

Eight years of stress-filled retirement was likely something, I am certain, that the Flynn’s did not expect when they settled down into what should have been a comfortable retirement.

How do you avoid the same fate?

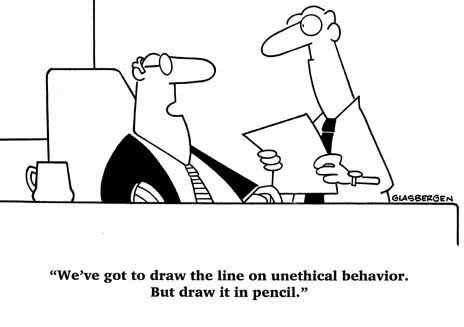

First and foremost, make sure that your advisor is bound by a legal fiduciary duty to ensure that you are properly and correctly invested in a portfolio of assets that meet your risk requirements and tolerance, your future goals and objectives, your time horizon’s for achieving those goals and your cash flow needs. Banks and the traditional investment broker / advisor will, in most cases, not give you this. You need to look beyond what the marketing and advertising themes suggest. Not easy in this country, where from an early age we are taught to trust these storied financial institutions. Until you hear about stories like the Flynn’s and others. Believe me, I have worked for some of these institutions, they pay lip service to client needs (allowing regulations to be toyed with in an effort to secure revenue sources, i.e. commissions) and put their shareholders first. In my opinion, an enormous conflict of interest.

Unfortunately, the fractured regulatory regime in the investment industry in Canada allows these institutions to “self-regulate” which is also fraught with conflict. As the Globe and Mail article suggests: “The lack of a binding dispute-resolution service for Canadian investors has long been flagged as a gap in the regulatory framework.”

Always ask the question: Are you a fiduciary? Are you legally bound to act in my best interest at all times? Any answer other than a clear, concise and unequivocal “Yes”? Walk away.

Want to read more? Go here: ADVISOR TITLE TRICKERY