Stock markets (the US in particular) have been climbing steadily higher since the bottom in March 2020 and the two reasons most cited are: 1) interest rates are so low, there is no alternative (the acronym TINA) and 2) the US Federal Reserve and Government are putting so much stimulus/money supply into the system that it has to go somewhere.

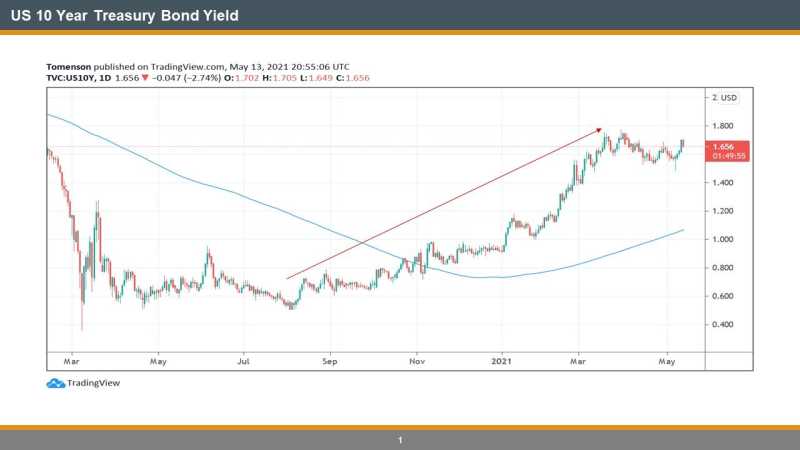

1) Well, interest rates may still not be where they were 15 years ago, but they are higher today than a year ago (US 10yr T-Bond in yield):

And if USA Bank Deposits are a potential harbinger of things to come for the money supply, then maybe, just maybe, money supply isn’t growing as quickly.

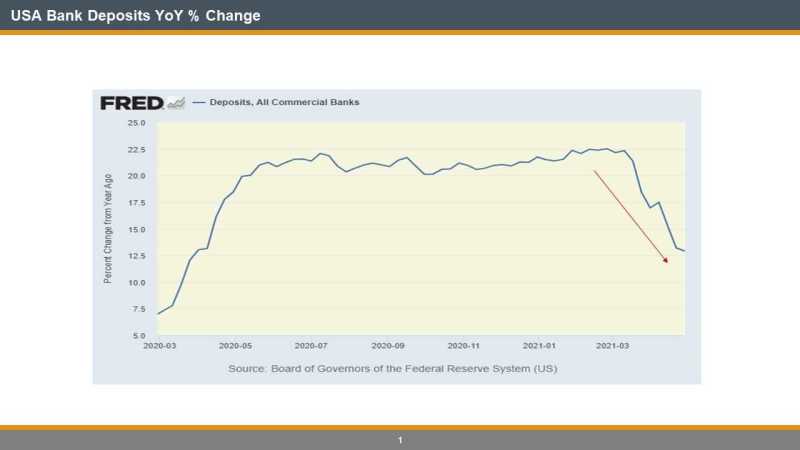

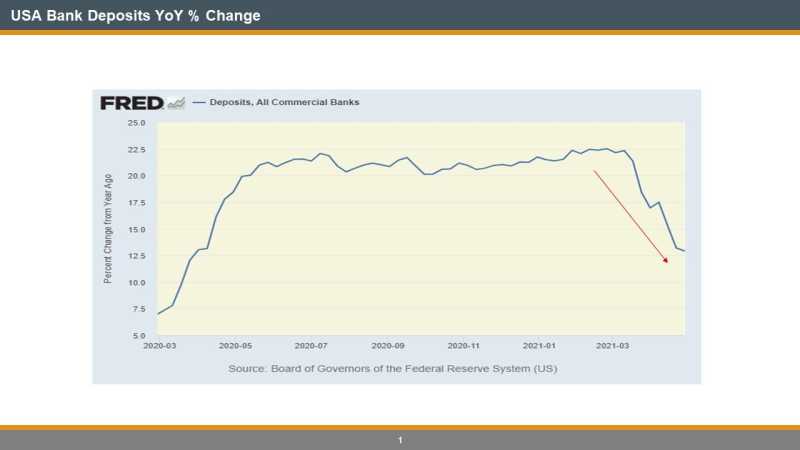

Below is a graph from the US Federal Reserve that tracks All Commercial Bank Deposits (a good proxy for money supply) on a weekly basis and shows the percentage change year-over-year (yoy):

Deposits were growing at ~23% yoy clip, but now are growing at only a ~13% rate.

Has the Fed changed its policy without telling us? Are they more concerned about inflation than they claim? Are they concerned about speculation in all assets from lumber (see the meme about the guy willing to trade (even up) a 4’x8′ sheet of plywood for a used F150 with less than 10,000kms on it?) to copper to stocks to bitcoin?

Not sure, but I do know that if what drove asset prices higher has changed, then asset prices themselves might change as well.