Only three weeks into 2022 and 2021’s portfolio gains are disappearing, especially if you rely on a passive balanced mandate like the Mawer Balanced Fund (MAW104) which has shed about 1/2 of its 2021 gain in that short period of time. Higher interest rates are coming (from central banks whose mandates are to keep inflation at or near to 2%) , government bond yields are climbing and bond prices are falling. So are stock prices. For balanced funds with 60% equity and 40% bond market exposure, that is a “double whammy”.

The S&P 500 is lower by about 4%, the All Country World Index (ACWI) ETF is lower by about 3%, The S&P/TSX is flat. The NASDAQ is down by almost 7%. Smaller company stocks (Russel 2000 index) are lower by about 6.5% and the once high flying ARK Innovation ETF (ARKK) is lower by about 18%. Interestingly, ARKK is down by more than 50% from its 2021 highs, echo’s of 2000?

Not helping balanced mandates, the Canadian bond index ETF, XBB is down by about 3.75%.

So what do you do?

Some will take the long-term approach (for the time being anyway) and sit on their hands. If we look back to the 2000-2010 decade (which followed a boom in equity prices through the 1990’s), where returns were meagre, those with retirement dreams in the next 5 to 10 years may want to think long and hard about their time horizons and their expectations.

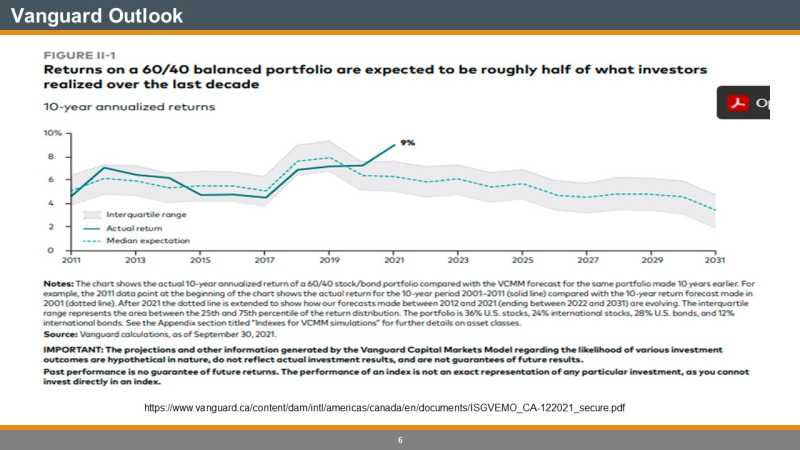

The strategy folks at Vanguard (the mutual fund and ETF company) see a shrinking long-term return for balanced mandates over the next 10 years.

Maybe its time to think about a more tactical approach to your balanced portfolio. High Rock clients already understand the benefits of a more tactical approach as their portfolios are not as vulnerable to the types of swings that 2022 has thrown at balanced portfolios thus far (not dissimilar to the downside protection received in the 2020 sell-off). The gains from 2021 are better protected thanks to some value added by our tactical model’s exposure to the under-value in energy markets and an underweight exposure to government bonds in our fixed income model. If anyone would like to chat in greater detail and explore the benefits of non-correlated assets, feel free to get in touch.

And as is always the case, past performance is not a guarantee of future returns. However at High Rock we work darn hard to manage risk so as to get our clients the best possible risk-adjusted returns.