Canada’s Ombudsman for Banking Services and Investments (OBSI) is a national, independent and not-for-profit organization that helps resolve and reduce disputes between consumers and financial services firms. High Rock Capital Management is a member firm of the OBSI.

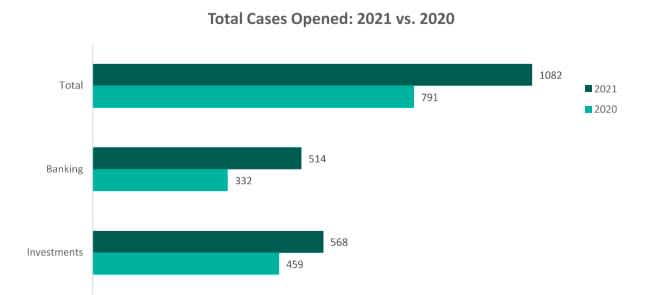

In 2021, case volumes reached an all-time high, notably surpassing the previous record set in the aftermath of the global financial crisis. In 2021, OBSI opened a total of 1,082 cases compared to 791 cases in 2020, representing a 37% year-over-year increase.

Source: https://www.obsi.ca/en/case-data-insights/resources/documents/case-stats/2021/FY2021_EN.pdf

“The ongoing pandemic has presented challenges for consumers and financial services firms alike. Despite our collective hope to return to normal life in 2021, unfortunately we instead faced continuing uncertainty and renewed concerns and economic disruptions. Throughout this difficult period, OBSI has been called on to serve more consumers than ever before, reinforcing the importance of fair, effective and trusted ombudservices, especially during periods of economic uncertainty,” said Sarah Bradley, Ombudsman and CEO, OBSI. “OBSI remains a committed provider of an important public service and focused on keeping pace with this ever-growing need.” Among investment products, complaints related to common shares became the leading investor concern with a 59% year-over-year increase. This was largely influenced by rising cases related to do-it-yourself (DIY) investor platforms.

In Canada we are conditioned to trust in our financial services institutions, at least that is the marketing narrative that they spend millions of dollars on advertising to try to make us believe. Those millions of dollars come from the fees that are gathered from clients who hope that they are the financial institution’s priority. Unfortunately (and I have worked for a number of them in my time), clients are not the priority, shareholders are.

When a client is not looked after as they should be, they have, fortunately, the OBSI in their corner. However, there are alternatives to those institutions that may over-sell their stated (but debatable) desire to serve. But who wants to have to go through the complaint process in the first place?

Those financial institutions do not have a legal fiduciary duty to their clients.

As an independent (no shareholders to report to), discretionary portfolio manager, High Rock has a legal fiduciary duty to their clients. Not only do we put our clients interests ahead of our own, but we actually do care about our clients and their money.

Food for thought perhaps?