Covid-19 and the fiscal and monetary policy response (which I maintain that monetary policy was highjacked by Sovereigns using central banks for fiscal stimulus) that followed, created what some have termed as “Hyper Asset Price Inflation”.

Over 2020 and 2021, this massive fiscal and monetary response sent all assets soaring: stock markets, all bond (gov’t and corp) markets, housing, all commodities, new and used automobiles, etc. Those with assets, saw a huge bump in their net worth over those 2 years and clearly they went on a buying spree for goods. With travel largely restricted, consumers spent that new found wealth on goods, not services.

But as Covid protocols changed around most of the world, consumers began looking for “life experiences” over the buying of goods. These life experiences included travel, concerts, sporting events, movies, dinners out, etc. This left some retailers in a precarious position, which I wrote about here. This switch from consumer goods to services greatly affected the price of inputs in goods manufacturing and has led to deflation of many assets.

Back to inflation. The US Fed appears very concerned (Don’t these folks have PhD’s in Economics? What did they think was going to happen with all that stimulus? Now, all of a sudden, they are inflation hawks…?) and is hell-bent on ramping up short interest rates, which is pushing the U$ higher, which is restricting liquidity on a global basis as it makes all/most assets more expensive as most are priced and traded in U$ (oil, metals, lumber, crypto, etc.) which means that as the U$ rises, one can buy less of that underlying commodity, so the commodity falls.

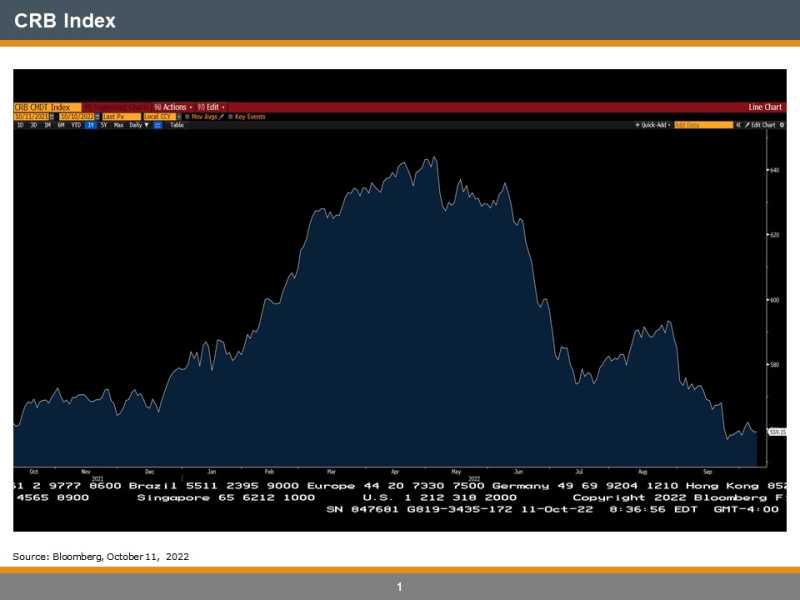

So, after 2 years of hyper asset price inflation and a substantial amount of monetary tightening in the system in a short period of time, we now have hyper asset price DEFLATION. I could go through every single commodity that is off substantially from their recent peaks, but how about we just use the Commodity Research Bureau’s CRB Index?

This shows a decline from just over a year ago of about 14%. And this includes oil and gas, which are off their highs but still higher over that period. Looking inside, we can see that some well-known commodities that are off substantially: Copper is off by 28% from the April/22 highs, Cotton is off 42%, Lumber is off a whopping 66%. Even some food like Wheat is off 29%, Soybeans are off 22% and Corn is off 16%. And of course, most people know Housing is off its March 2022 highs by some 15+% (in Canada) and the S&P 500 is off about 26%. All of these examples represent huge deflation.

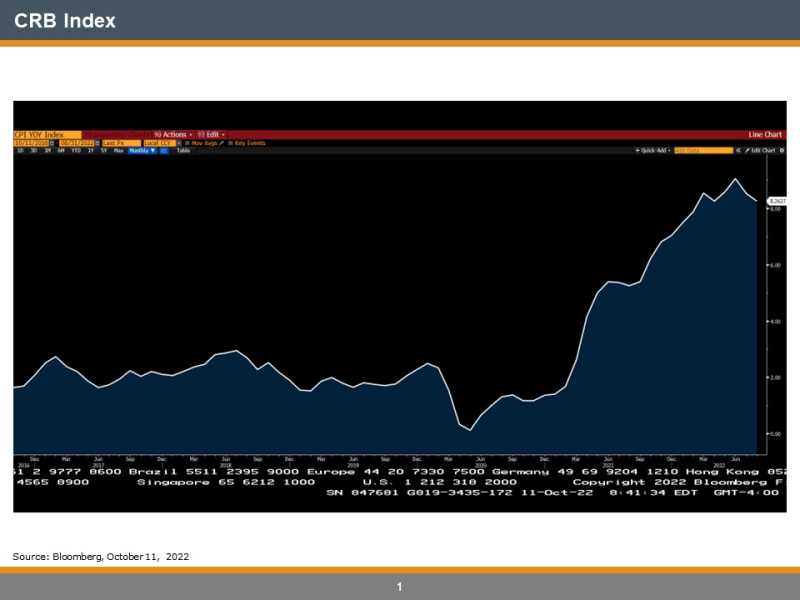

And if we look at US CPI (even the Headline which includes Energy and Food), we can see that it might, just maybe, be starting to roll over. Intuitively, that makes sense when all these input costs are deflating as dramatically as they are.

Now, to be sure, this is only a small roll over in inflation. The US Fed clearly wants to be sure that inflation is beaten into the ground. But if asset prices are deflating as rapidly and dramatically as they are, what is holding inflation up so high?

I think the only line item that is contributing to inflation is – employment and wages (and perhaps rent on housing, which should be good for long term housing prices, especially in Canada where immigration plays catch-up from Covid). Below is the US Avg Hourly Earnings on a YOY basis.

This seems to be what the Fed is most concerned about. Employment remains strong and there have been quite a few union contracts which have rewarded employees with 5-10% annual raises. To be sure, this definitely adds to inflation, but there is a but – Employment is a lagging indicator. And evidence of that might be in the fact that the University of Michigan Consumer Sentiment Index is the lowest it has ever been! When employees do not feel confident about job security, they quickly turn and spend less. Regardless, US Avg Hourly Earnings look to have peaked anyway.

And where is all this monetary tightening of financial conditions leading us in the face of asset price deflation? Recession. Back in early January of this year, I wrote a blog that showed how recessions begin and end. It is always the Fed (and other Central Banks, like the Bank of Canada) playing catch up to the real economy, which moves at a much faster pace. (This is why High Rock was in a defensive position at the beginning of the year). The $64,000 Question is, has the asset price deflation we have seen express enough recessionary risks already or is there more to discount?

At High Rock, we think there is a bit more to go. We do believe that the market will push/test the Fed until they break and “pause”. Some are looking for what is called a “pivot” by the Fed where they turn and start cutting rates. We are not so sure they do that but we do see a day in the not too distant future where the Fed pauses saying that they put an awful lot of tightening into the system and they want to wait and see the effect. But even to see a pause, we will need to see inflation roll over more. By that time, we will likely see risk assets deflate further. And don’t believe what the Fed says, believe what they actually do. Right now, they say they want to bring inflation back down to 2%…if they keep raising rates until even their measurement of core inflation hits 2%, we won’t have a recession, we will have a depression, given the amount of combined public and private debt across the global system. Also a consideration for the Fed as it marches on, is the US Midterm Elections that occur next month along with a chorus of investors, legislators (especially in non-US nations who are feeling enormous economic pain) and now even the UN, telling the Fed (and other Central Banks) to stop raising rates.

In the meantime, at High Rock we have added some credit and interest rate risk like some higher rated (BB) high yield corp bonds that are yielding 7% and some investment grade corp bonds that yield 5.5%. We have several positions in our Tactical Model that have proven reasonably stable due to strong free cash flows that support their underlying securities, so they have been helpful. In our Global Equity Model, we are close to dipping our toes in to add a bit but feel we are not quite there yet.

If we had to ascribe a baseball term, we would say we are in the 7th inning of this market sell-off. The market is getting there but we will wait till it pushes the Fed closer to the pause button.