I find it incredibly remarkable that all the folks who were pounding the table on buying GIC’s and abandoning balanced portfolios about this time last year have gone quiet. Actually, I don’t really, because that’s what happens when a bad idea turns sour. Nobody wants to talk about it anymore.

It is a great lesson however, in human behaviour and more specifically, behavioural finance: financial decisions around things like investments, risk and personal debt which are greatly influenced by human emotion, biases and cognitive limitations of the mind in processing and responding to information.

And bad advisors who know how to manipulate us into acting on those emotions. If you think your advisor is selling you an investment that she or he claims is in your best interest, that should raise a caution flag. Immediately!

Fear of high grade bonds with low coupons (annual interest rate payments) was certainly a chief issue for the GIC camp to weave into the unsuspecting balanced portfolio investor. Failing to point out that a low coupon bond trading below its par value (at $0.85, for example) would move to par ($1.00) as it approached maturity, giving a tidy 15% capital gain! while at the same time paying a 1.5% annual income payment.

GIC’s are 100% taxable as income.

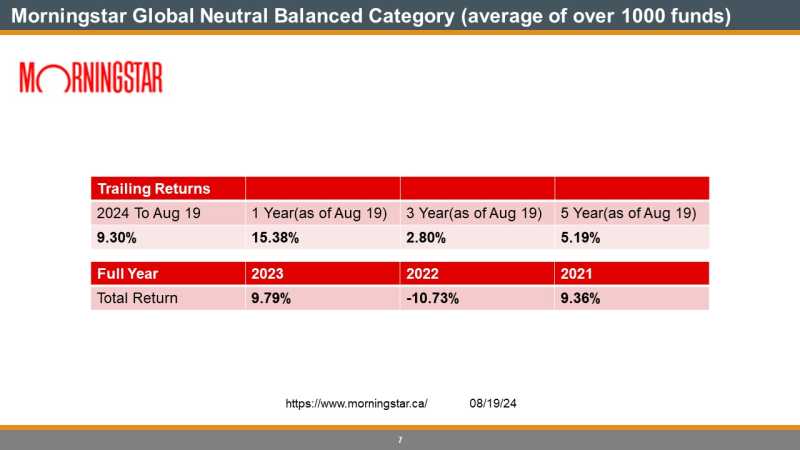

Morningstar, the mutual fund and ETF analytics company, tell us that on average (over a thousand global balanced funds), that since last August, balanced funds have grown at a pace of 15.38%. Not all fully taxable as income.

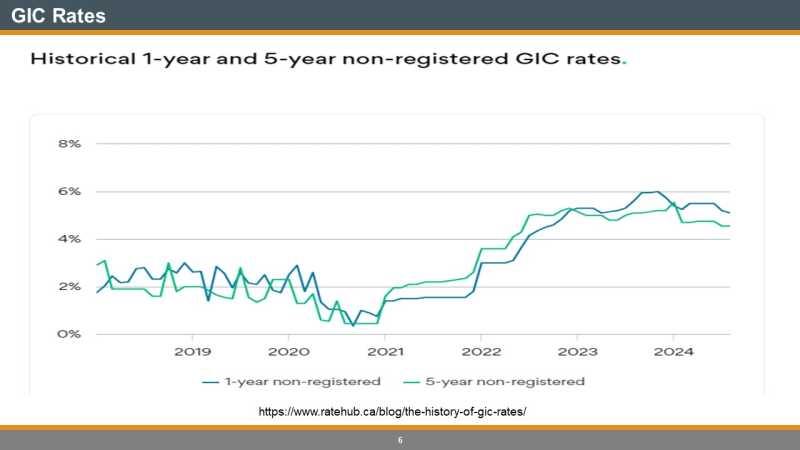

The best you could have got for a GIC at this time last year was 6%. Fully taxable as income.

And even comparing the 5 year histories: Balanced portfolios have averaged 5.19% since August of 2019 (and there have been some pretty wild swings in financial markets over this time frame). A 5 year GIC back in 2019 might have got you 3%.

Broadly speaking, I think that most of our High Rock clients within balanced mandates have had a better than average experience (depending on their individually tailored asset allocation and portfolio structure and when they joined us) over the last 5 years.

Perhaps it is time to get more than just advice. Get solid portfolio management.