The eternal debate: what should the composition of my investment portfolio be?

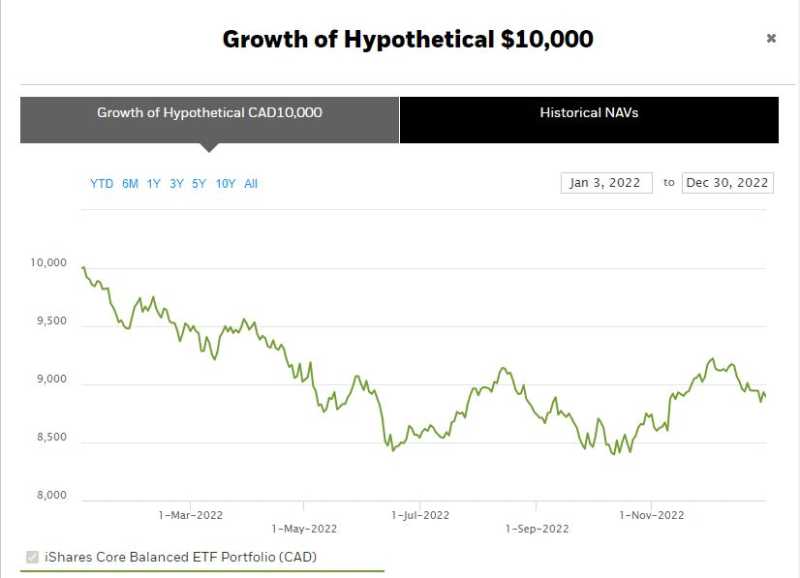

It was inevitable that this would become a hot topic in 2023 after most passive balanced portfolios suffered from negative growth in the double digits in 2022. As an example, the I-Shares Core Balanced ETF had a total return (including distributions of interest and dividend income) of -11.08%. That might be a good comparison if you are looking at your own portfolio returns from 2022. That particular ETF portfolio has an approximate weighting of 60% equity ETF’s and 40% fixed income ETF’s. (More in-depth holding’s information can be found here: I-Shares Core Balanced ETF Portfolio Holdings).

Source: click here

However, while all the “talking heads” (and bloggers) rant on about the debate over portfolio composition, investors need to perhaps step back and think about their investments in a much longer-term perspective. If you are pre-retirement (millennials, etc.) you may have some 50 or so years of investing ahead of you. If you are retiring you still may have 20-30 years still ahead of you, so some perspective should be in order. Most importantly, if you have a plan and that plan meets your long-term goals, stick to it. Tweak it, perhaps, if necessary, but one difficult year should not derail your long-term strategy.

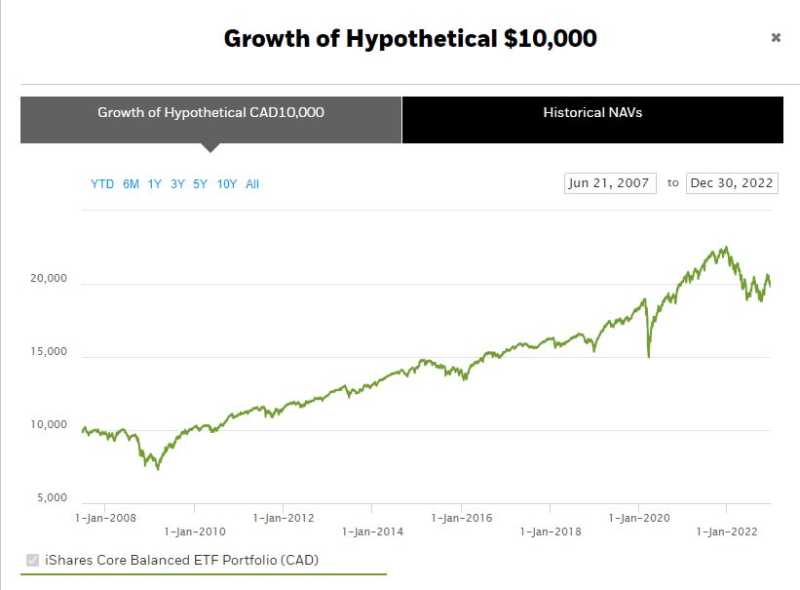

That being said, and as I always will suggest, we need to manage our expectations: Since 2007, this same balanced ETF has grown at an annualize total return close to 4.5%. 14 1/2 years and a number of cycles (and 4 negative years).

Source: click here

Our long-term strategy needs to embody our need for growth and with that, the level of risk that we are willing to accept to achieve our goals (and stay ahead of inflation): can we emotionally survive a double digit decline in the value of our portfolio in any given year? Clearly we need to understand that if we are to remain passively balanced, we should not be expecting more than a 4-5% annual average level of growth (over longer periods of time). If you need to see a higher level of growth, then perhaps the passive, one size fits all portfolio is not necessarily for you?

Perhaps, as well, there are more flexible strategies that work harder to reduce risk and at the same time maximize growth? A combination of passive and tactical portfolio management?

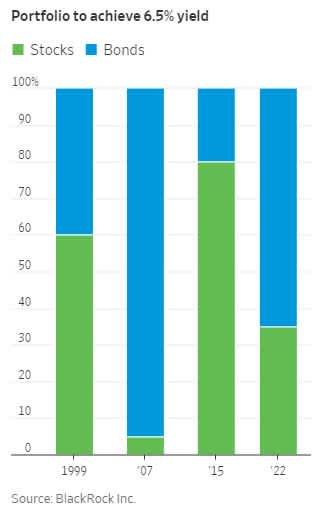

Blackrock, ironically the manager of I-Shares ETF’s, is suggesting a switch to a more fixed income weighted balance because current yields are higher (as interest rates have risen) and bond prices dropped:

Source: click here

That is a tactical shift in strategy, attempting to find better growth opportunities and find higher annual returns but still keep risk at somewhat reasonable levels.

Source: click here

The Sharpe Ratio is a measure of risk per unit of return. At High Rock, we manage risk first, so this becomes an important aspect of everything that we do for our clients as we tailor their strategies in an effort to maximize their returns (in accordance with their goals) while appropriately managing the risk associated with their investment strategies. Risk-adjusted returns. In 2022 our clients certainly had some favourable experiences along these lines, relative to most balanced mandates.

So, 60-40? 40-60? Passive? Tactical? The answer lies in our goals: the need for portfolio growth to stay ahead of inflation and the managed risk that we are willing to take to get to our goals. Everybody will have different goals, so why should it be a one size fits all strategy? It shouldn’t. Period.

And of course: past performance is in no way a guarantee of future results, but at High Rock we work darn hard to make sure that we get the best possible risk-adjusted returns for ourselves and our clients and move ourselves forward towards our goals.